Philippines

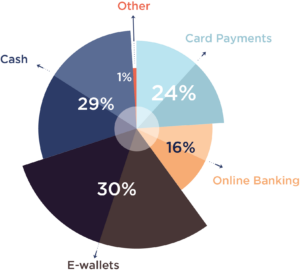

The Bangko Sentral ng Pilipinas (BSP) has estimated that soon almost half of all retail payments across the Philippines will be facilitated through digital methods, this based on sustained growth in the sector following the COVID-19 pandemic. In fact, the central bank is confident that 70% of Filipino adults will have either a bank or ewallet account by 2023. This surge is driven by the rapid adoption of ecommerce in the country. Online purchasing is expected to further grow at a CAGR rate of 16% over 2022-25 to reach US$9.7 billion. This rise in digital payments is attributed to the rapid adoption of E-wallets within the country. The share of ecommerce payments facilitated via digital wallets stood at 30% in 2021, up from 21.0% in 2017.

By the numbers

Ewallets are starting to displace traditional payment methods like cash and cards in the Philippines.

Statistics of note

'22 Projected ecommerce revenue

Ecommerce payment method penetration

Popular local payment methods

In 2022, digital payments, including cards, ewallets and real-time banking payments made up 20% of all retail payment transactions in Philippines.

Visa

Visa Inc. is a payments technology company that provides digital payments across more than 200 countries and territories.

Mastercard

Mastercard Inc. is the second-largest payment-processing corporation worldwide.

GrabPay

GrabPay is a digital wallet launched by the ridesharing service, Grab. Consumers can link their credit or debit card to their GrabPay account to make payments online and through the Grab app.

Maya

Maya is an online payment account that has an app that consumers can load with funds in convenience stores, pawnshops and malls to make purchases online.

GCash

GCash is a Philippine mobile wallet, mobile payments and branchless banking service.

Bancnet

BancNet is an online banking facility which allows ATM cardholders to enjoy the convenience and security of making banking transactions without having to go to a physical bank branch or payment centre

ECPay

Electronic Commerce Payments, Inc. (ECPay) is a secure electronic depot for electronic loading, bill payments, airline ticket payments, cash-in service and online shopping.

Cebuana Lhuillier

Cebuana Lhuillier is the Philippines’ leading and largest micro financial services provider specializing in pawning, remittance, microinsurance, and micro saving.

Bayad Center

Bayad Center is a multi-channel payment platform offering the public a reliable and convenient bill payment service.

Growth drivers

Digital payments are on the rise in the Philippines. Here are 3 reasons why:

Female ecommerce categories

In the Philippines today, a greater proportion of women (27%) transact digitally than men (23%). This trend follows most other metrics of financial and digital usage – account ownership (39% of women in the country own one as opposed to 30% of men), paying bills online (12% of women state using digital payment tools compared to 8% of men), online purchases (11% of women versus 7% of men), and remittances (49% of women regularly send them compared to 42% of men). As the Philippines rapidly accelerates its national digitization efforts, the country has quickly become a leader in the digital engagement of women, creating a unique opportunity for businesses targeting female and family ecommerce categories.

Huge opportunity to digitize merchant payments

Payments to merchants comprise 95% of overall retail payments. While this represents the bulk of transactions in the Philippines, only 15% of the country’s merchants accept digital payments, and even then, it’s on an ad hoc basis rather than as a standard purchasing channel. Unsurprisingly, the potential for payment digitization is huge amongst the country’s sizeable micro and small merchant sectors.

Rapid growth in digital payments

Despite challenges, digital payment adoption continues to grow at a rapid pace within the Philippines. 20.1% of total financial transactions in the Philippines were digital in 2020, up from 14% in 2019 and 1% in 2013. The government hopes to accelerate this adoption and is pushing for upwards of 50% of all retail payments across the Philippines to be executed digitally by 2023.

Fragmentation focus

Malaysian consumers are ready for global brands. Here’s how payment fragmentation might impact your expansion efforts in the region:

Ewallets are fast becoming the preferred payment method

There are multiple digital wallet players in the Philippines with GCash, Maya (formerly PayMaya), PayPal and GrabPay all boasting significant usership in the country. GCash alone accounted for 18.2% of the country’s total ecommerce payment value in 2021 (in the year prior, Gcash and Maya collectively captured 91% market share of all e wallet transactions). To benefit from the growing preference for digital wallet solutions, online shopping platforms such as Shopee and Lazada now offer their own digital payment solutions (ShopeePay and Lazada Wallet, respectively).

The rise of QR codes

The Philippines government has taken various measures to increase the adoption of electronic payments in the country. QR Ph (the national QR standard), which was initially available for P2P payments, was extended to merchants – both online and in-store – in 2021. Thanks to this extension, consumers can now make interoperable mobile-based payments by scanning a QR code at a merchant’s outlet or on a business’ online checkout page, irrespective of the payment solution provider. There are now more than 473,000 businesses nationwide that accept QR Ph, representing a 566% increase compared to when QR Ph originally launched the merchant solution. P2P transactions via QR Ph have also been on the rise, with 171.7% growth in volume and 252.5% increase in payment value year-on-year since 2021.

Cards remain relevant

Debit cards dominate the Philippines card market with 90.6 million debit cards in circulation (compared to 8.6 million for credit and charge cards). Even so, credit and charge cards remain the preferred form of plastic, accounting for nearly two-thirds of card payments by value. This is mainly due to pricing benefits, instalment payment plans, and speciality reward programs that are attached to the country’s most popular cards. Card payments in the Philippines remain extremely relevant and are expected to register at a CAGR of 12.3% between 2020 and 2024 to reach US$59.8 billion in 2024 from (up from US$43.4billion in 2021).

Pay attention to the payment preferences of the unbanked populous

Given that the majority of Filipinos are unbanked, salaries, government payments and remittances are still mainly fulfilled by cash. As such, cold hard cash remains the dominate payment method in the country, accounting for almost 80% of all payments made in 2020. In fact, five out of 10 online shopping transactions are even paid for with coins and bills. This is why over-the-counter (OTC) payment methods (where customers deposit the money in person at retail locations such as 7-Eleven for items purchased online) is such a critical go-to-market requirement for businesses planning to expand in the region. Numerous OTC options are available in the country, including options from retail locations like 7-Eleven, Cebuana, Bayad Center, ECPay, Ever Superstores and Gaisano.

View other country guides

Review our country guides to learn more about the ecommerce and payment landscape in each region.

Is the Philippines on your expansion roadmap? NomuPay is here to assist.