Turkey

With more than 78 million cellular mobile connections in country, it’s obvious that Turkey (known globally as the Republic of Türkiye) takes connectivity seriously; over 90% of the population has a cellular phone, with mobile activations increasing by 2.5 million (3.3%) between 2021 and 2022. Internet penetration is also high, with 82% of the total population (close to 70 million people) reporting having access as of early 2022. Data from the Ministry of Trade shows the number of ecommerce transactions increased to 3.4 billion in 2021, up nearly 46% from the previous year. Ecommerce sales volume in the same period rose to TRY385.1 billion (US$21 billion). This is bolstered in part by the country’s young, social-media savvy populous. There are reportedly over 68.9 million social media users in Turkey, which equates to a staggering 80.8% of the total population.

By the numbers

Turkey offers international marketplaces and brands an exciting expansion opportunity. Understanding the payment landscape can help brands garner market share fast.

Statistics of note

'22 Projected ecommerce revenue

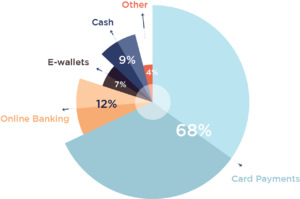

Ecommerce payment method penetration

Popular local payment methods

Turkey is characterised by a large unbanked/under-banked population. This plays an important role in the country’s payment preferences.

Visa

Visa Inc. is a payments technology company that provides digital payments across more than 200 countries and territories.

Mastercard

Mastercard Inc. is the second-largest payment-processing corporation worldwide.

Troy

Troy is Turkey’s domestic card scheme. More than 20 Turkish banks issue a range of credit, debit and prepaid Troy cards.

DCB

DCB (Direct Carrier Billing) is an online mobile payment method which allows Turkish consumers to make purchases by charging payments to their mobile phone carrier bill<.

Growth drivers

Ecommerce is accelerating in Turkey. Here are 3 reasons why:

Sustained ecommerce growth post-COVID

Turkey’s ecommerce sector experienced monumental growth during the COIVID-19 pandemic as health concerns and mobility constraints forced consumers to re-evaluate shopping preferences. For example, online spending in Turkey now covers 5.7% of total fast-moving consumer goods (FMCG) sales (up from 4.0% in 2020). However, there’s still plenty of room for growth (by comparison, 31.6% of Chinese fast-moving consumer goods are purchased via online means). The shift to online shopping is becoming more and more evident as ecommerce grew by 88% across all categories in financial year 2021 versus 2020 and continued to grow by 68% through April 2022 versus the same period the previous year.

Strong national banking industry

When it comes to banking, technology usage and digitalization, Turkey is fast becoming a country to watch. For example, did you know that there are 82.8 million credit cards in Turkey, making it the 7th country globally for credit card usage? In terms of the number of credit card transactions, Turkey ranks 9th in the world and 1st in Europe. Not surprisingly, card payments are the preferred payment method in Turkey, thanks to a mature market and broad ranging features, including installments and deferral/postpone payment plans. Combine this with the country’s more than 1.7 million point-of-sale devices, a 48% in-store contactless payment ratio, 52,100 ATMs and 70.3 million active digital banking customers and you can begin to see how Turkey ranks as a global leader in the banking industry.

Favourable payment regulations

Since 2020, numerous regulations have been issued by the government with the goal of strengthening in-region fintech innovation, encouraging bank digitalization and promoting open banking technology. Spurred on by the onset of the COVID-19 pandemic, Turkey announced new regulations supporting a wide range of digital initiatives in the financial sector including digital onboarding, digital signing of contracts and a national QR code standard. The launch of the Digital Turkish Lira Cooperation Platform followed closely on the heels of these regulations in 2021. Additional regulations paved the way for authentication

via video calls, the notarization of contracts in electronic environments and a government mandate of near-field communication (NFC) technology as the primary method for identity document authentication.

Fragmentation focus

Navigating Turkey's unique business landscape

Official rules and government-regulated processes have been known to make it challenging for foreign companies to enter the Turkish market. Legislation and regulations change frequently which makes it difficult for foreign companies to adapt. As such, many overseas companies look to collaborate with domestic partners, local consulting companies and/or law firms to overcome these obstacles.

Recent and significant currency rate fluctuations have posed continuing problems for companies exporting to and importing from the country. This is because payment problems are very likely to occur.

As a precaution, it is highly recommended for parties to agree upon on a predetermined exchange rate level with a local partner. In addition, it is advised to include clear and concise payment terms, including foreign exchange, in any contractual agreement, prior to engaging in any sizeable business in the Turkish market.

View other country guides

Malaysian consumers are ready for global brands. Here’s how payment fragmentation might impact your expansion efforts in the region:

Ready to expand into Turkey? NomuPay can help you go-to-market.