Indonesia

According to NielsenIQ, the number of Indonesian consumers using e-commerce grew to 32 million in 2021, which represents an increase of 88% from 2020 (17 million people). And there’s more where that came from. According to the country’s Ministry of Finance, Indonesia’s e-commerce usage is projected to reach US$37.1 billion by the end of 2022. That being said, this amount would still only account for 12.5% percent of the country’s overall retail market. As the trend towards online shopping continues, so too do consumer payment habits and the preference for digital methods. Together, these factors could push the Indonesian e-commerce landscape to grow to US$83 billion by 2025.

By the numbers

The ecommerce landscape in Indonesia has grown significantly in recent years.

Statistics of note

'22 Projected ecommerce revenue

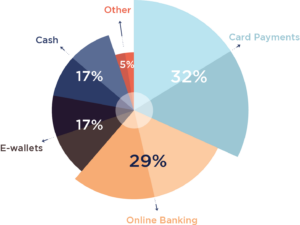

Ecommerce payment method penetration

Popular local payment methods

Indonesia is characterised by a large unbanked/under-banked population. This plays an important role in the country’s payment preferences.

Visa

Visa Inc. is a payments technology company that provides digital payments across more than 200 countries and territories.

Mastercard

Mastercard Inc. is the second-largest payment-processing corporation worldwide.

Shopee Pay

Shopee Pay can be used to make online purchases within Shopee, offline transactions with merchants who accept payment via ShopeePay and also for receiving or transferring payments to other users.

GoPay

GoPay is an electronic payment method and part of the Gojek app. Consumers can conduct transaction from their mobile phone at over 900,000 merchants in Indonesia.

OVO

OVO is a digital payment service that offers simple payment and smart financial services./p>

DANA

Dana is an all-in-one app that allows consumers to easily make cashless and cardless payments.

LinkAja

LinkAja merged the digital payments services of five different state-owned companies. It allows consumers to top up credit, shop online, pay merchants, pay bills, send money and more.

Alfamart

Alfamart is one of Indonesia’s most popular over-the-counter payment methods. Consumers buy items online and are able to pay for their purchases at their local Alfamart store.

Indomaret

Indomaret enables in-store cash payments for online purchase in Indonesia. Payments can be made over-the-counter at a local Indomaret location.

Growth drivers

Ecommerce is accelerating in Indonesia. Here are 3 reasons why:

Travel tops online spending categories

Travel is, by far, Indonesia’s most popular e-commerce retail segment. According to J.P. Morgan, 58.9% of all online purchases by Indonesians can be attributed to travel bookings. Clothing and apparel, Indonesia’s second most popular online shopping category, accounts for just 14.6% of the domestic e-commerce market. The opportunity for standout brands to influence consumer shopping trends in the country are arguably quite high.

The opportunity for cross-border online commerce

Right now, local online marketplaces such as Lazada, Tokopedia, Shopee and Bukalapak dominate the Indonesia e-commerce sphere, generating by far the most browsing and spending traffic. Experts believe that this could easily change, however, as many international merchants have begun to (successfully) target this relatively untapped region.

Growth of mobile and social commerce

Clocking in at US$7.1billion, Indonesia has one of the fastest-growing mobile commerce markets in the world… and expected to keep growing. This is because the country’s smartphone penetration was just over 70% in 2021; by 2026, it’s expected to grow to 82% . Apps are the primary mobile sales channel, accounting for 74.8% of the mobile commerce market. What’s more, selling via social media sites, such as Instagram’s Stories festure, has become relatively mainstream. As a result, it’s estimated that social commerce will grow by 55.0% annually, accounting for a projected US$8.7 billion in 2022 or 23% of the country’s total ecommerce sales value.

Fragmentation focus

Malaysian consumers are ready for global brands. Here’s how payment fragmentation might impact your expansion efforts in the region:

Card usage continues to increase

Despite low card penetration (0.59 debit cards per capita and 0.07 credit cards per capita) plastic remains the dominant online payment method in Indonesia. It’s anticipated that the card payments market will continue to grow by 10.7% and reach IDR619.5 trillion (US$44.2bn) by the end of 2022. Indonesians are still cautious when it comes to credit, however. Credit and charge cards payments are expected to register just 5.4% growth over the same period due partially to reduced consumer spending travel amongst ongoing Covid-19 resurgence concerns. The value of debit card payments, on the other hand, were expected to grow by 14.3% in 2022, as more online consumers get comfortable migrating away cash transactions.

How many ewallets is too many?

In 2021, the value of electronic money transactions in Indonesia reached US$18.74 billion, this according to the country’s central bank. To say the market for this alternative payment method is fragmented would be an understatement; the country currently has more than 48 licensed e-wallet platforms, including domestic players from both public and private sectors. That being said, there are clear winners in this space. In 2020, GoPay ranked first among the most used digital payment platform in Indonesia, followed by OVO, Shopee Pay, DANA and finally the government-owned e-wallet LinkAja. The dominant e-wallets in Indonesia are embedded payments apps (e.g. Shopee Pay and GoPay) within high-penetration marketplace and on-demand apps (Shopee and Gojek). Not surprisingly, these platforms were able to not only attract high traffic during the pandemic, but are now proving able to maintain ongoing consumer demand. Even so, independent e-wallet like OVO, DANA and LinkAja have more flexibility to expand their products and offer various financial services to their customers.

Government support is helping accelerate digital payments in the country

Despite 51% of the population being unbanked, online transfers are the second-most popular e-commerce payment method in Indonesia. Growth in this area is supported by improved digital infrastructure, including the country’s adoption of virtual accounts and the country’s Quick Response Code Indonesian Standard (QRIS), a standardised QR code backed by Bank Indonesia. Virtual accounts are viewed as a highly convenient payment method as they allow customers to pay via ATM or Internet banking; as such, these accounts have become the most popular way to make a bank transfer in Indonesia. QRIS has further served to accelerate the development of the country’s digital payments landscape by harmonizing services offered by digital payment providers – including mobile wallets, digital banking and apps – under a centralised QR code. With the QRIS, merchants only needed to put up one QR code to accept all payment methods, and consumers now have the freedom to pay with any method of their choice. QRIS has been adopted by over 15 million merchants as of June 2022.

Cash is on the decline, but still a popular payment method

Prior to the pandemic, Indonesia was primarily a cash-driven economy. Take cash-on-delivery, for example. This once popular method declined to 11% by late 2022; it’s expected to decline by another 6% by 2025. This decrease in cash payments has been due primarily to government countermeasures aimed at stopping the spread of Covid-19, along with incentive programs focused on increasing the adoption of contactless and mobile payments. Regardless, cash over-the-counter payment options remain highly relevant in Indonesia given that more than half the population remains unbanked. Currently there are more than 20,000 convenience retail locations (Alfamart and Indomaret chains) that act as over-the-counter payment collection points within the country.

View other country guides

Review our country guides to learn more about the ecommerce and payment landscape in each region.

Need help with your Indonesia expansion efforts? NomuPay can help.