Thailand

Presently, ecommerce accounts for just 2% (or US$26.2 billion) of overall retail in Thailand, with only 23% of the population having stated they shop online. Thailand continues to move up the ranks in the World Bank’s “Ease of Doing Business” report, shifting from 27th to 21st in 2020 (the report was discontinued after this year). Considered to be the second largest economy in Southeast Asia, Thailand has a population over 128 million people, and ranked as the fifth most touristed country by US News in 2021.

By the numbers

Thanks to a young, social-media focused population, and high smartphone and bank penetration, the conditions required for ecommerce growth have been established in Thailand.

Statistics of note

'22 Projected ecommerce revenue

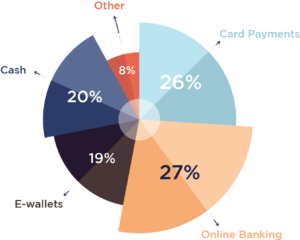

Ecommerce payment method penetration

Popular local payment methods

As mobile commerce continues to grow, look for Thai consumers to turn increasingly to convenient mobile wallet methods. These are projected to earn upwards of 28% share of point-of-sale by 2025.

Visa

Visa Inc. is a payments technology company that provides digital payments across more than 200 countries and territories.

Mastercard

Mastercard Inc. is the second-largest payment-processing corporation worldwide.

TrueMoney

TrueMoney Wallet is Thailand’s leading e-wallet for all mobile carriers.

Rabbit LINE Pay

Rabbit LINE Pay is an ewallet that allows users to pay for goods both off and online, transfer money to other LINE users, pay utility bills and more.

PromptPay QR

PromptPay QR is a Thai payment method that allows customers to make a payment using their preferred app from participating banks via QRC.

Lotus’s

Lotus’s (formerly Tesco Malaysia) is Thai supermarket chain that allows its customers to pay for bills and online purchases with cash in its stores.

Growth drivers

Ecommerce is growing at a rapid rate in Thailand. Here are 3 reasons why:

Key fast-growing ecommerce categories

The most popular online shopping category in Thailand is travel, accounting for 57% of the total market. Consumer electronics (11%) and fashion (10%) are the second and third-most popular categories, respectively. Thailand is also considered a forerunner in live-streaming and direct-to-consumer commerce.

Highest ecommerce and growing cross-border spend in ASEAN

The average online spend per person in Thailand is significantly higher than in many other Southeast Asian countries. For example, Thailand’s average online spend is US$1,738, compared with just US$484 in Malaysia and US$230 in Vietnam. This suggests a consumer appetite for higher-ticket items and, possibly, that ecommerce is at present restricted to higher-earning citizens. In addition to the high spend, cross-border ecommerce accounts for almost a third (30%) of the overall ecommerce market in Thailand (roughly US$8.1 billion per annum). To put that into perspective, almost half (49%) of online shoppers in Thailand have reported making a purchase from abroad with China being the most popular overseas market to shop from, followed by Japan and the US.

Mobile-first ecommerce market

Thailand’s mobile commerce market is worth an estimated THB490 billion (US$15.8 billion), a figure that is set to grow at a compound annual growth rate (CAGR) of 12.2% by 2023 to THB775 billion (US$25 billion). This is driven primarily by increased smartphone penetration and an established consumer preference for mobile shopping. In fact, our research has found that Thailand has one of the highest rates of mobile commerce at 57%. More than 97% of Thai Internet users rely on their smartphone to access the Internet, compared to only 25% who use a laptop. It goes without saying that any market entry strategy for the country needs to be mobile-first, otherwise businesses risk losing out on almost half the available consumer base.

Fragmentation focus

Thinking of scaling your business into Thailand? Here’s how payment fragmentation might factor into your strategy:

Cash remains critical

Cash-on-delivery and over-the-counter cash payments remain a relevant feature of the Thai ecommerce market. According to a survey carried out by the Bank of Thailand, the country shows a marked reluctance to move away from cash. The study showed that at least 50% of people will continue to use only cash for day-to-day payments while nearly all respondents said they felt cash was a necessity for daily life.

Wallet usage is on the rise

Digital wallets are currently used to pay for 19% of ecommerce transactions. Over the next five years, mobile wallet usage is expected to more than triple in terms of users and transaction value, with transaction volume expected to increase by more than 7x. There are several mobile wallets available to consumers in Thailand, with TrueMoney being the largest (52% market share), followed by Rabbit LINE Pay (24%), ShopeePay, mPay, GrabPay and others.

Building better banking infrastructure

Bank account penetration in Thailand is good and is rising, currently standing at 82%. PromptPay, the Bank of Thailand’s national real time QR-based bank payments system, has revolutionized the way Thai consumers receive and send money, especially for among small businesses and street vendors. It has attracted more than 55 million users and serves consumer-to-business payments, corporate payments and cross-border payments within Thailand and across Southeast Asia. PromptPay instant payments can be used for P2P, QR-code payments at point-of-sale, making tax payments and receiving tax refunds. The value of PromptPay transactions has increased from US$545billion to US$870 billion in 2021, signifying a growing preference for bank payments as the dominant way to pay in the country. Bank transfers are used at roughly the same rate as cards when shopping online (27%).

View other country guides

Review our country guides to learn more about the ecommerce and payment landscape in each region.

It's time to expand into Thailand. Contact NomuPay for more information on local payments.