Malaysia

Malaysia’s digital payments market and ecommerce gross transaction value (GTV) is expected to reach US$6 billion in 2022, doubling from the US$3billion in 2019. It is expected to grow to a total of US$13 billion (RM54.6 billion) by 2025, with almost all transaction conducted using digital payments. The country remains a dynamic and business-friendly environment with well-developed infrastructure and optimistic growth prospects. Ranked 12th in the World Bank’s final “Ease of Doing Business” report, published in 2020, Malaysia became even more pro-business when in March of 2022 it became the 12th signatory country to implement the Regional Comprehensive Economic Partnership (RCEP) agreement.

By the numbers

Digital payments, which include cards, ewallets and real-time banking payments has risen significantly in Malaysia over the past decade, most notably during the COVID-19 pandemic.

Statistics of note

'22 Projected ecommerce revenue

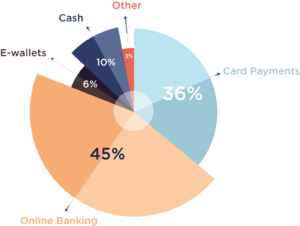

Ecommerce payment method penetration

Popular local payment methods

Since online banking payment methods can be used for online and offline transaction, it’s no surprise that they’re becoming an increasingly popular payment option for Malaysians.

Visa

Visa Inc. is a payments technology company that provides digital payments across more than 200 countries and territories.

Mastercard

Mastercard Inc. is the second-largest payment-processing corporation worldwide.

Touch ‘n Go

Touch ‘n Go is an ewallet that can be used to pay bills via the app or to pay for shopping in-store in Malaysia.

FPX

FPX (Financial Processing Exchange) is a Malaysia-based online payment method that allows customer’s to shop online using their bank credentials.

DuitNow Online

DuitNow Online provides a lets customers transfer money using easy-to-remember DuitNow IDs such as mobile number and NRIC number.

DuitNow QR

DuitNow QR is an interoperable QR standard that allows Malaysians to make payments and receive funds from any participating Bank and ewallet with a single QR code.

Shopee Pay

Shopee Pay can be used to make online purchases within Shopee, offline transactions with merchants who accept payment via ShopeePay and also for receiving or transferring payments to other users.

GrabPay

GrabPay is a digital wallet launched by the ridesharing service, Grab. Consumers can link their credit or debit card to their GrabPay account to make payments online and through the Grab app.

Boost

Boost App is a Malaysian mobile wallet that consumers can use to make payments without the hassle of using physical cash.

7-Eleven

7-Eleven is an over-the-counter payment method that is initiated in an ecommerce environment but completed by paying in cash at a 7-Eleven retail location.

Growth drivers

Ecommerce is growing at a rapid rate in Malaysia. Here are 3 reasons why:

Cross-border commerce continues to grow

Nine in 10 Malaysian consumers prefer global brands. Cross-border spending is high in Malaysia, accounting for four out of every 10 ecommerce transactions in the country. Malaysian shoppers are willing to buy from international ecommerce sites, with 48% having already made a purchase from an overseas vendor. The top three countries for cross-border sales are China, Singapore and Japan.

Last-mile delivery infrastructure bolsters the ecommerce market

When it comes to delivery, 90% of Malaysians expect their purchase to be delivered within a week, and 4% of Malaysians expect their delivery within three days. It’s no surprise then that couriers and businesses alike are investing in their Malaysian last-mile offerings. DHL, for instance, has set up domestic last-mile delivery operations in Malaysia and there are dozens of national, local, and regional delivery players such as POS Malaysia, NinjaVan, J&T Express, and ABX Express that have risen to meet the need for ecommerce-fuelled logistical demand.

Government-backed push for cashless society

In 2020, the Malaysian government introduced the e-Tunai Rakyat programme and the ePENJANA initiative, which granted consumers cash handouts through ewallets like Touch ‘n Go (TNG), Boost and GrabPay. A total of US$265 million was allocated to stimulate the Malaysian economy, increase consumption and promote digital adoption as part of both initiatives. This was further supported by national agencies like the Malaysia Digital Economy Corporate (MDEC) which has the mandate to digitize the Malaysian economy. MDEC ran two six-month programs in 2020 – Go-eCommerce Onboarding and Shop Malaysia Online – each with the goal of promoting digital payments and online commerce. These initiatives generated US$1.2 billion combined. The ePemula initiative launched earlier this year gave US$35 in E-wallet credit to youths aged 18 to 20 and full-time students, allocating a total of US$66 million under the national budget.

Fragmentation focus

Malaysian consumers are ready for global brands. Here’s how payment fragmentation might impact your expansion efforts in the region:

Card usage continues to grow

The Malaysian card payments market is set to record a robust growth of 15.2% in 2022, supported by the gradual rise in consumer spending, government financial inclusion measures and an increasing preference for contactless payments. The value of card payments in Malaysia recorded a strong growth of 15.9% in 2021 and is forecasted to register a compound annual growth rate (CAGR) of 11.5% over 2022-26 to reach US$96.5 billion in 2026.

Bank transfers are the preferred choice

Bank transfers are the most common ecommerce payment method in Malaysia, accounting for 45% of all transactions. This is evident given that bank penetration is at 96%. Furthermore, domestic banks have launched their own branded bank transfer options, along with interbank payment methods such as FPX, which is operated by the national payment scheme. Both methods are now widely used to pay domestic bills. In fact, online banking transactions registered a 41.5% increase to 3.5 billion transactions from 2.5 billion in 2020

Ewallets are proliferating

Ewallets are used more for out-of-home consumption (e.g. eating out, retail and in-store grocery spend). It’s worth noting that the Malaysian E-wallet ecosystem is highly fragmented, with more than 50 bank and non-bank providers. 78% of Malaysians have more than one ewallet, with users gravitating toward Touch N’ Go, ShopeePay, Boost, Grab and MAE. Merchants have also been quick to adapt. The total number of merchant registrations for the national interoperable QR infrastructure DuitNow (which allows business to display a single QR code to their customers, instead of multiple QR codes unique to each accepted ewallet) increased by 59.4% to 1.1 million as at the end of 2021, from 0.7 million merchant registrations at the end of 2020. Ewallet transactions have increased 74.4% to 1.1 billion transactions in 2021 from 0.6 billion transactions in 2020 and is expected to grow further. Online bill payment services has also increased over the past two years, especially with physical bill payments counters being forced to closure during the COVID-19 induced lockdowns.

Making cross-border commerce easier

Increased cross-border interoperability of the Malaysian national QR scheme with other real-time national QR schemes in the ASEAN region provides an added opportunity for businesses looking to expand outside of the country. For example, businesses that accept DuitNow QR in Malaysia can also accept payment from users in Thailand who are on the PromptPay mobile payment application for online cross border e-commerce transactions, and vice versa.

View other country guides

Review our country guides to learn more about the ecommerce and payment landscape in each region.

Make your move in Malaysia. NomuPay can help you tackle local payments.