Hong Kong

Hong Kong is heading towards a near-cashless society with forecasts reporting paper money and coins will account for no more than 1.6% of point-of-sale transactions by 2024, the lowest in the Asia-Pacific region, and down from 9% in 2019. Businesses looking to set up physical brick and mortar stores in the country can gain traction by displacing cash accepting merchants. The overall point-of-sale market in Hong Kong is forecast to increase by almost 27% to US$236 billion by 2024.

By the numbers

The disappearance of cash is Hong Kong society in part due to the country’s burgeoning ecommerce market, which is projected to grow to US$38 billion by 2025 up from US$26 billion in 2022.

Statistics of note

'22 Projected ecommerce revenue

Ecommerce payment method penetration

Popular local payment methods

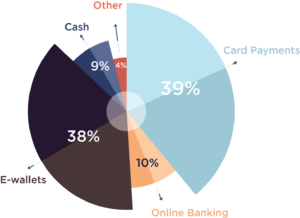

While cards remain the most popular ecommerce payment method, alternative payment methods are quickly gaining in consumer popularity.

Visa

Visa Inc. is a payments technology company that provides digital payments across more than 200 countries and territories.

Mastercard

Mastercard Inc. is the second-largest payment-processing corporation worldwide.

UnionPay SecurePlus

UnionPay is the national bankcard association in China.

WeChat Pay

WeChat Pay is a mobile payment and digital wallet service by WeChat based in China.

Alipay

Alipay is a digital wallet in China that has more than a billion active users worldwide.

Growth drivers

Hong Kong is fast becoming an international ecommerce powerhouse. Here are 5 reasons why:

Sophisticated ecommerce-spending behaviours

When Hong Kong citizens shop online, they are willing to spend: the average annual online spend is robust, at nearly US$2,000. Travel, health and beauty, and consumer electronics are the top three ecommerce categories in Hong Kong.

High Internet usage vs. low ecommerce penetration

There is huge potential for ecommerce growth in Hong Kong given that Internet penetration is high at 90%. Even so, only a quarter of Hong Kong’s citizens currently shop online, and ecommerce accounts for just 10% of Hong Kong’s total retail spend. In contrast, in mainland China, ecommerce takes a 23.1% share of the overall retail market.

Cross-border spending spree

Cross-border spending is high with 75% of Hong Kong’s online shoppers having made a purchase from overseas vendors. In fact, cross-border spending constitutes the majority of the region’s online purchases, at 70% of total ecommerce spend or US$2.2 billion in sales.

Growth of New digital payment methods

Cross-border spending is high with 75% of Hong Kong’s online shoppers having made a purchase from overseas vendors. In fact, cross-border spending constitutes the majority of the region’s online purchases, at 70% of total ecommerce spend or US$2.2 billion in sales.

Rise of omnichannel online-to-offline models

Shopping malls are open seven days a week and are easily accessible to the population. In the past, brick-and-mortar retailers enjoyed booming sales from the influx of Chinese tourists. However, with the social unrest in Hong Kong in 2019 and onset of COVID-19, retailers have realized the importance of digital transactions and an omnichannel approach. Online platforms such as HKTVmall.com have opened offline concept stores, whereas traditional retailers, like Chow Tai Fook Jewellery Group, rolled out an online-to-offline sales channel called CloudSales 365. Built on WeChat Work, CloudSales 365 made it easy for frontline and back-office staff in mainland China to promote and sell products to their families, friends and customers using social media.

Fragmentation focus

Thinking of expanding into Hong Kong? Here’s how fragmentation might factor into your plans:

Cards are key to your success

Cards remain the most prevalent way to pay in Hong Kong both online and off. In 2021, nine in 10 Hong Kong citizens reported having used a credit or debit card to pay for goods during the pandemic. Cards are the leading way to shop online in Hong Kong, used for just under half of all ecommerce payments, or US$1.8 billion in annual sales and is specifically dominated by Visa, Mastercard and UnionPay credit cards.

Ewallets are gaining traction

Digital, mobile and ewallets are the second most popular payment option in Hong Kong, used for a quarter of all ecommerce transactions, or US$0.9 billion annually. However, ewallets and digital wallets transactions are expected to grow faster than card transactions, expanding at a compound annual growth rate of 32% and is expected to eventually overtake cards to become the primary ecommerce payment method in Hong Kong. The most used ewallet brands include WeChatPay, AliPay and PayPal, and popular mobile wallets include ApplePay, GooglePay and SamsungPay.

Get ready for real-time expectations

Real-time bank transfers occupy a 10% share of the Hong Kong ecommerce market, with this payment method expected to grow rapidly at a compound annual growth rate of 28%. The daily average number of FPS transactions in March 2022 – a time period in which COVID closed 600 of the city’s 1,100 bank branches – was HK$6.3 billion, up from HK$2.4 billion in early 2020; representing 38% growth. This is largely driven by the rise of online subscription services, digital wallets and real-time bank payments, including the state-backed Faster Payment System, which boasts more than 10 million registered users. The Faster Payment System allows citizens to transfer funds 24/7 via a mobile number or email address. It can also be used to fund local ewallets where supported. On the merchant side, businesses benefit through instant deposits from consumers.

View other country guides

Review our country guides to learn more about the ecommerce and payment landscape in each region.

Need help with your Hong Kong expansion efforts? NomuPay has your back.