Choosing a payment gateway is one of the most important decisions for any business, especially an e-commerce store. With so many options available, it’s not always clear how to choose the right payment gateway for your specific business needs. In this guide, we’ll walk you through what to look for in a payment gateway—from fees and features to scalability and security—so you can find the best online payment solution for you.

What's in this article:

Payment gateways enable businesses to accept card and online payments from their customers, either from an e-commerce website or in-store with a card machine reader, by authorising the transaction.

It does this by:

Need to know more about how a payment gateway works before you consider how to choose one? You can find out more about it in our payment gateways explained article. Alternatively, if you have an e-commerce store, you can check out our guide on what an e-commerce payment gateway is to get the basics first.

—

Did you know?

How people shop for payment gateways has changed. Nowadays, in the payment space, every service tends to be bundled together into one package.

So people don’t really shop around for different types of payment gateways anymore. Really, in 2023, it’s better to get into the mindset that what you’re shopping around for is an online payments provider who can offer a complete package that’s well-suited to your business model.

We highly recommend you consider the following factors when selecting the right payment gateway for your e-commerce website, marketplace or even physical store:

Typically, a payment gateway will come prepackaged with three fees you’ll have to pay. Those are:

In most cases, merchants discover that the fees required for services add up fairly quickly. On top of the usual fees mentioned above, there are registration fees, payment processing fees, refund fees, transfer fees, batch fees and even limit fees. Another big one for merchants to think about is the Merchant Discount Rate (MDR), which takes a small percentage of each value processed on behalf of your business (this fee is attached to the merchant account).

You’ll want to think about all potential costs before committing to a decision, as what looks like the best deal on the surface might not necessarily be the case with a little research. Ultimately, you’ll want to settle on a payment gateway provider who will be transparent with their requirements and flexible in their service agreements.

Want a better understanding of pricing structures? Take a look at our interchange fees explained blog.

Some payment gateways put a limit on how many transactions you can process on a monthly basis. For some smaller businesses, this might not be a problem. However, if you’re dealing with a lot of expensive goods or experience a sudden surge in business — and you are not aware of these limits — you could end up losing out on a lot of money and customers.

You’ll want a global payment gateway that can easily accommodate fluctuations or rapidly increasing amounts of payments at any given time. Finding a gateway provider that does not have limited growth options will take one more hurdle off the track. For example, we provide an acquirer-agnostic payment gateway to connect our merchants to our local acquirers and network of third-party acquirers all over the world. Combined with our ability to intelligently reroute transactions, helps to increase authorisation rates and successful global payments.

Some payment gateway providers have their own plugins for e-commerce platforms and alternative payment methods (APMs) like Apple Pay and Google Pay. These plugins can really enhance the shopping experience for customers who like to pay predominantly with their mobile phones.

So if you are looking for a payment gateway, ask the provider if they have their own plugins and if they can demonstrate the effectiveness of them.

If a gateway approves a payment instantly, it doesn’t necessarily mean they are the best type of gateway. The trick is determining how long it might take for the money to make it from this approval stage into your merchant bank account.

This holding period or ‘processing time’ can be as little as 24 hours but it could also be as long as one week, depending on your online payments provider.

It’s important that either the holding time doesn’t take too long or that your payment gateway provider has a rolling reserve policy in place as a safeguard in the case of any chargebacks or refunds. Make sure to ask your provider about both the holding time and if they have a rolling reserve policy.

It’s also worth noting that high-risk merchants will have longer processing periods than low-risk merchants, so you will need to bear that in mind too.

It’s crucial that you find out what payment types your payment gateway will accept. Most of them will accept the big players — such as credit and debit cards from the major card schemes like Visa and MasterCard. But more and more customers are paying with many smaller alternative payment methods.

So, which payment types does your customer base prefer? It could be that you need a gateway that supports multiple currencies or that is better attuned to accept recurring payments.

Whatever gateway you choose, make sure it can handle the right type of payment methods your customers are using.

Some businesses are considered to work in ‘high-risk’ industries. Examples of such industries include cryptocurrency, gambling, gaming, the adult industry, the travel industry and so on.

Some online payment providers only deal with low to medium-risk businesses. So if your company operates in what you think is a high-risk industry, then you’ll want to make sure your payment gateway deals with your industry. Here at Nomupay, we specialise in high-risk and can offer a payment gateway and merchant account suitable for these sectors, such as the Forex industry, hospitality and digital goods.

Read more about high-risk businesses in our guide here.

A payment gateway is only a part of the puzzle; tt will be running alongside the general infrastructure of your website. Make sure the payment gateway you choose integrates smoothly with your e-commerce platform, whether it’s Shopify, WooCommerce or a custom-built store, as well as all of the plug-ins you have installed.

Being able to integrate your payment gateway into your platform is crucial, otherwise, it might make your website glitchy, or even break — this could cost you money as frustrated customers abandon their shopping carts.

If your business model is recurring payments/subscription-based, then it’s vital that you pick a payment gateway that is suitable for it. Any provider you choose must be able to save and store your customer details easily and safely so that they can be automatically charged on preset subscription schedules. Your gateway must also be able to offer re-attempts (in case the initial transaction fails).

If you don’t have a payment gateway to do all of these things, you may have to do them manually, which could cost you both time and money.

That’s why we offer a whole suite of subscription tools, like tokenisation, scheduler, auto-retries and account updater to ensure our merchants are well-equipped to succeed.

It will surprise no one to learn that receiving payments online is a favourite target for cybercriminals and fraudsters. To protect your customers’ data (and your company’s reputation), security should be at the top of your list when choosing a payment gateway for your e-commerce store.

Now, as a baseline, payment gateways are required by law to be level-1 PCI DSS compliant. But for extra security and peace of mind, you might want to think about a gateway that offers additional fraud and risk detection tools.

Read about our fraud & risk management tools

A good payment gateway will offer up a wealth of analytical tools so that you, as a business owner, can see exactly how and why shoppers are purchasing from your website. Advanced analytics like this are crucial because they allow you to detect potential loopholes in areas that may need improvement.

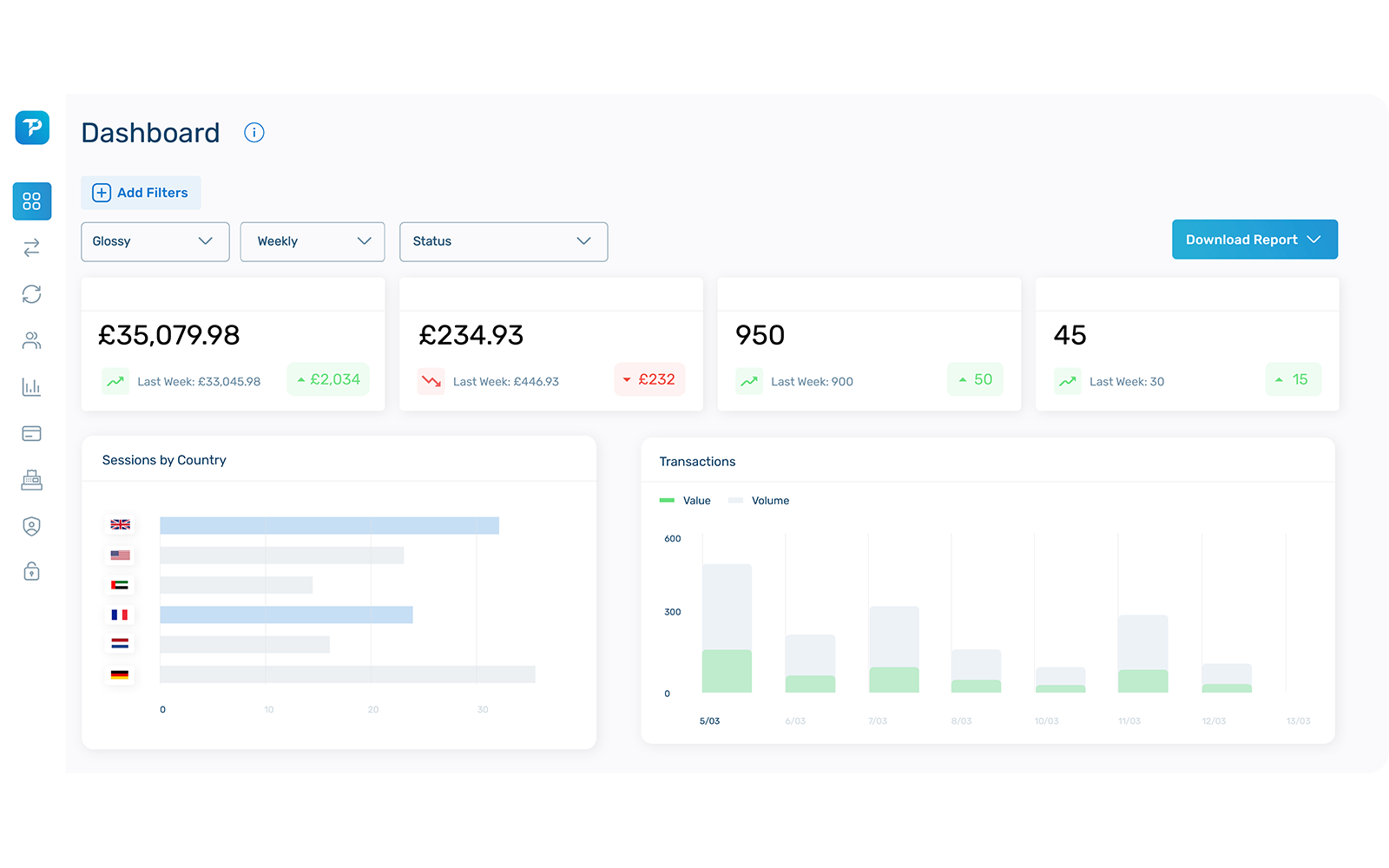

For example, our Unified Platform software offers a detailed payments overview with full visibility of your processing history, a unified approach to transaction management and smart reporting with real-time insights — to name a few.

All good payment gateways should make it as easy as possible to make payouts and refunds. They should also work to prevent user drops and failed transactions as much as possible.

For the majority of businesses, thousands of pounds will be processed through their payment gateway every day.

If for whatever reason, that gateway went down or crashed, that could cost the business a fortune.

So you’ll want to make sure that you get the best customer support possible. Only settle for a customer service that offers:

Only with all those boxes met can you be sure you’re on the right track.

| Factor | What to Look For |

| Fees | Transparent setup, monthly and transaction fees |

| Supported Platforms | Including but limited to Shopify, Magento, WooCommerce plugins |

| Currencies | Multi-currency and local payment methods |

| Security | PCI DSS Level 1, fraud detection tools |

| Customer Support | 24/7 support, dedicated account manager |

So there you have it, all the factors to consider when choosing a payment gateway for your business.

The bottom line: remember to choose with your business interests and customer’s requirements in mind. And make sure that it’s PCI DSS compliant. A good payment gateway is essential for customer satisfaction, trust in your brand and, in the long run, the success of your business. We recommend using this list as a guide.

Ready to choose the best payment gateway? Get in touch with us today to find out how

our all-in-one solution can meet your unique business needs—securely, affordably and at scale.