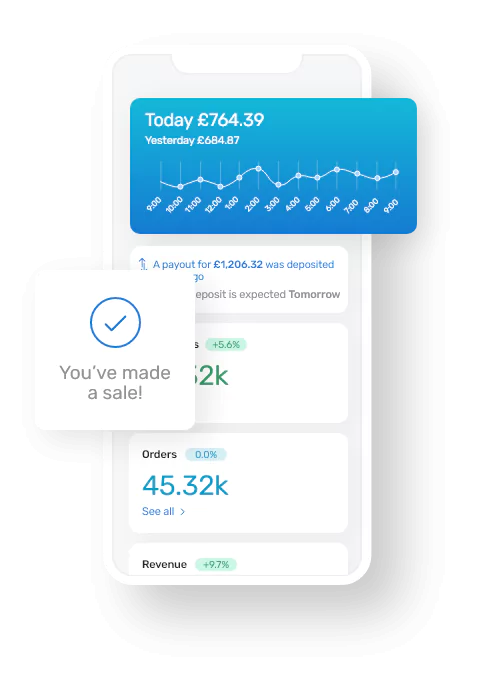

Once a customer has made a payment, those funds are sent to the acquiring bank that the merchant is partnered with. Each of these payments is then released within a pre-agreed amount of days and transferred to the merchant’s nominated business bank account. This timeframe is known as settlement days and varies depending on your acquirer.