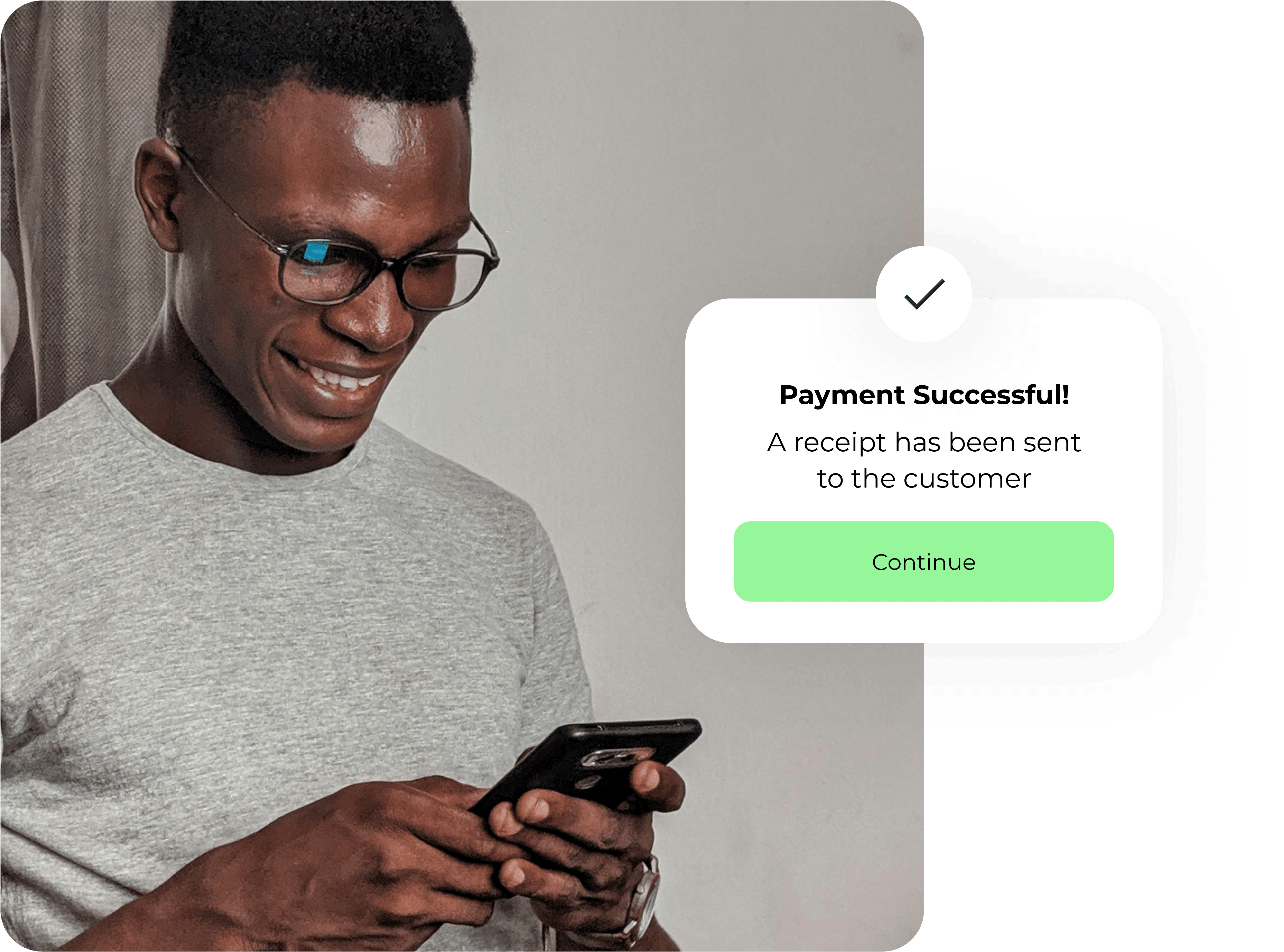

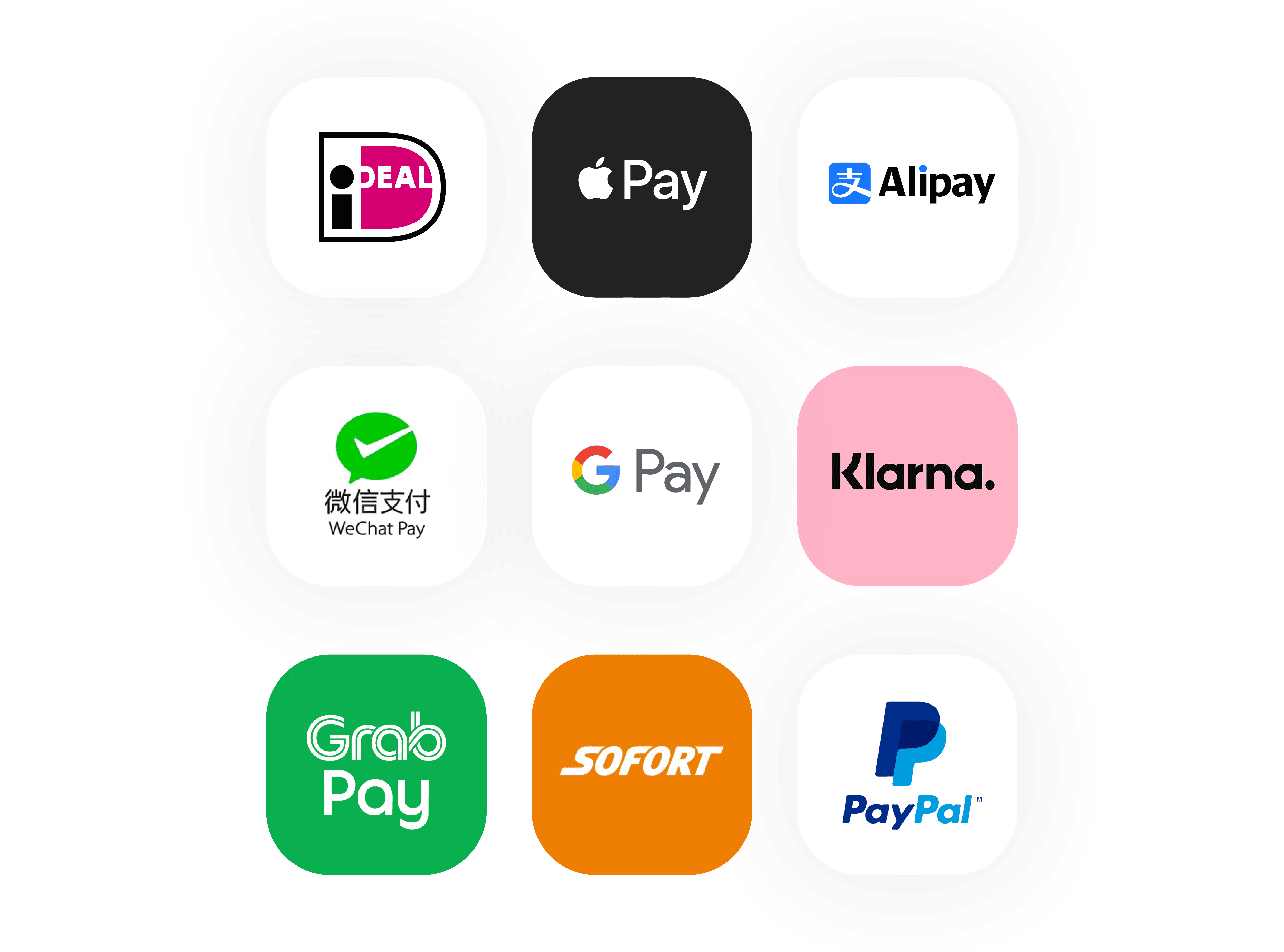

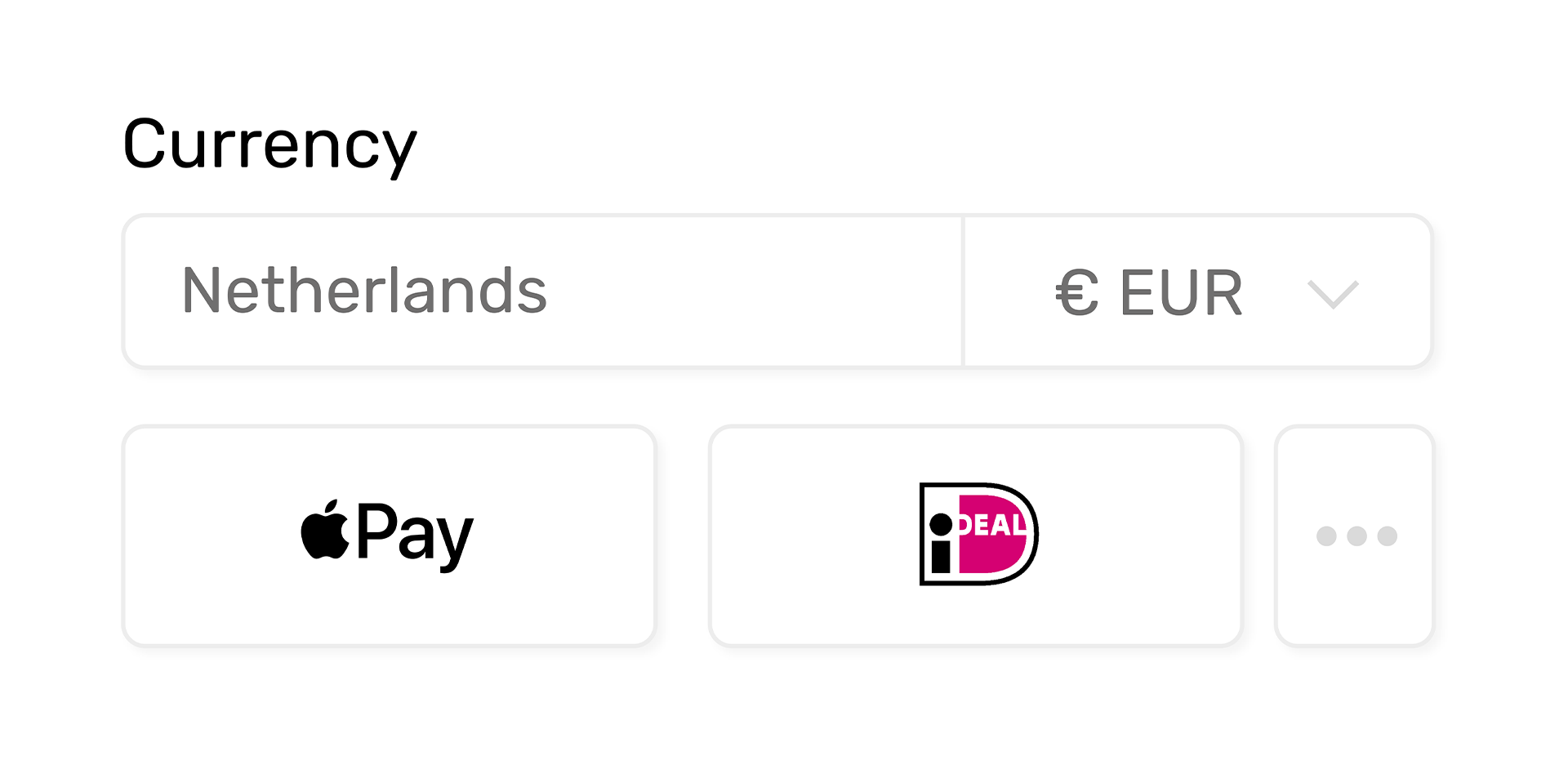

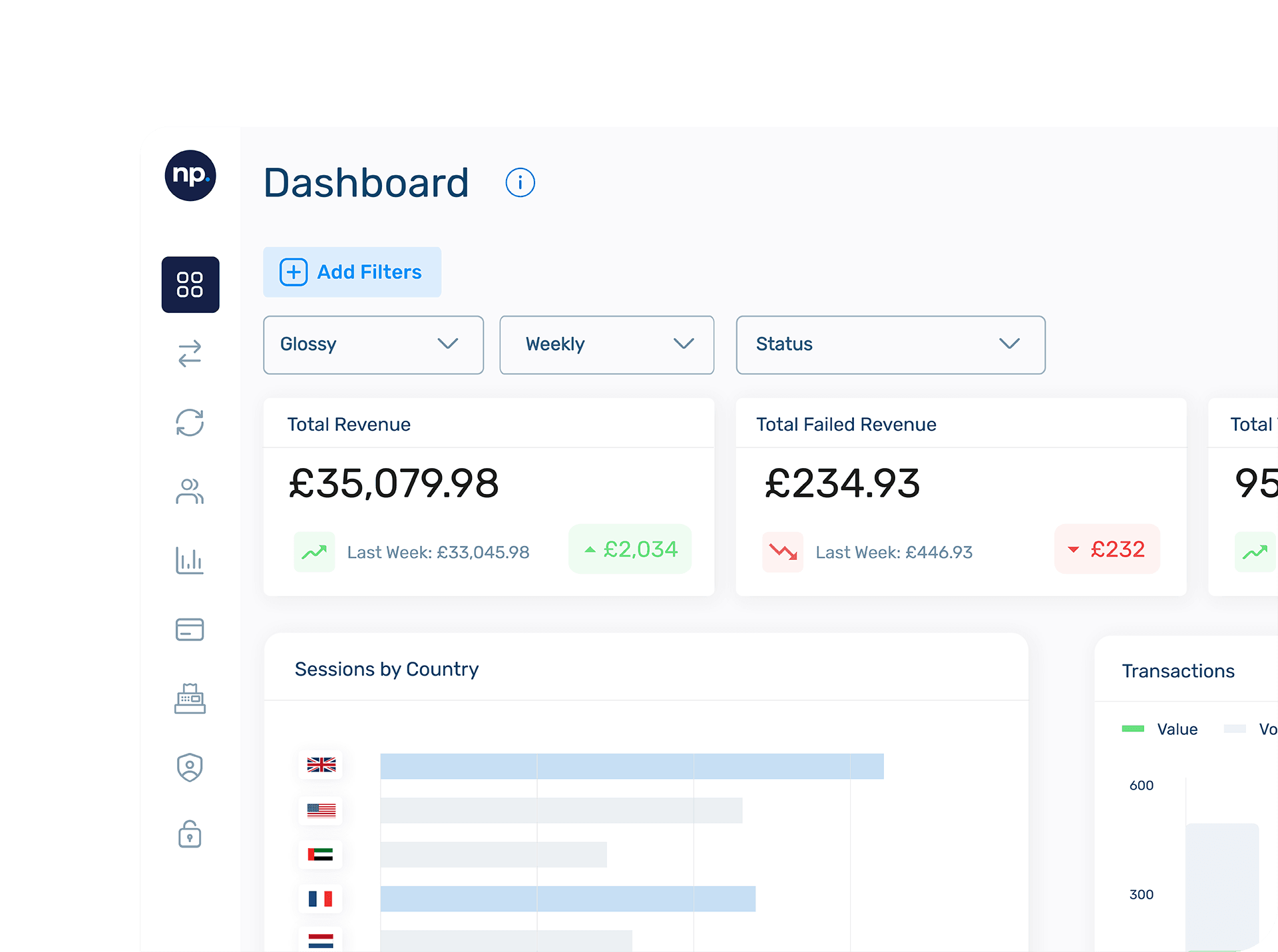

Build trust with local preferences! Provide your customers with real flexibility in how they pay including major debit and credit cards and popular local payment methods, like Apple Pay, iDeal and GrabPay. Settle funds and payout in both major and local currencies too.