Declined transactions are more than frustrating. They can have a severe effect on your business, losing sales and customer trust, ultimately affecting your bottom line. If approval rates are something you’re struggling with, your payment setup might be part of the problem.

Two crucial components of online payments are the acquirer, or acquiring bank — the institution responsible for accepting and processing card transactions — and the payment gateway.

That’s where an acquirer-agnostic payment gateway comes in. It could be the game-changer you need to reduce those declines and keep your cash flow smooth. But what do we mean by an acquirer-agnostic payment gateway and how do you get one?

What's in this article?

Let’s clarify that an acquirer and payment gateway are two very different things, so an acquirer-agnostic gateway may seem like a strange concept. With an acquirer, also known as a merchant acquirer or acquiring bank, being the bank account that accepts the merchant's deposits, and a gateway being the facilitator of the transaction, what does an acquirer-agnostic gateway mean and how will it reduce declines?

Before we delve into the meaning of an acquiring-agnostic gateway, it's also worth noting that there's another payment term that can also get bundled into the mix: merchant account. Want to know the difference between a merchant account and a payment gateway? We have a blog on that too!

But for now, let’s get back to learning about an acquirer-agnostic payment gateway.

Okay, first things first – what does "acquirer-agnostic" even mean? Simply put, it's all about flexibility. An acquirer-agnostic payment gateway doesn't tie you down to a specific acquiring bank. It connects you with all the major players in the financial world, allowing you to connect with the one that suits your business best. There’s no stopping at one either, you can be connected to as many as you need.

For example, here at Nomupay, we have our own acquiring licences as well as access to more than 300 acquiring banks locally and internationally. Choosing a payment gateway that works with multiple acquiring banks — also known as being acquirer-agnostic — gives you flexibility and resilience to scale globally, as well as so we can offer you the best chance for high approvals.

Now that we've covered the meaning of an acquirer-agnostic gateway, let's talk about why it matters for your business:

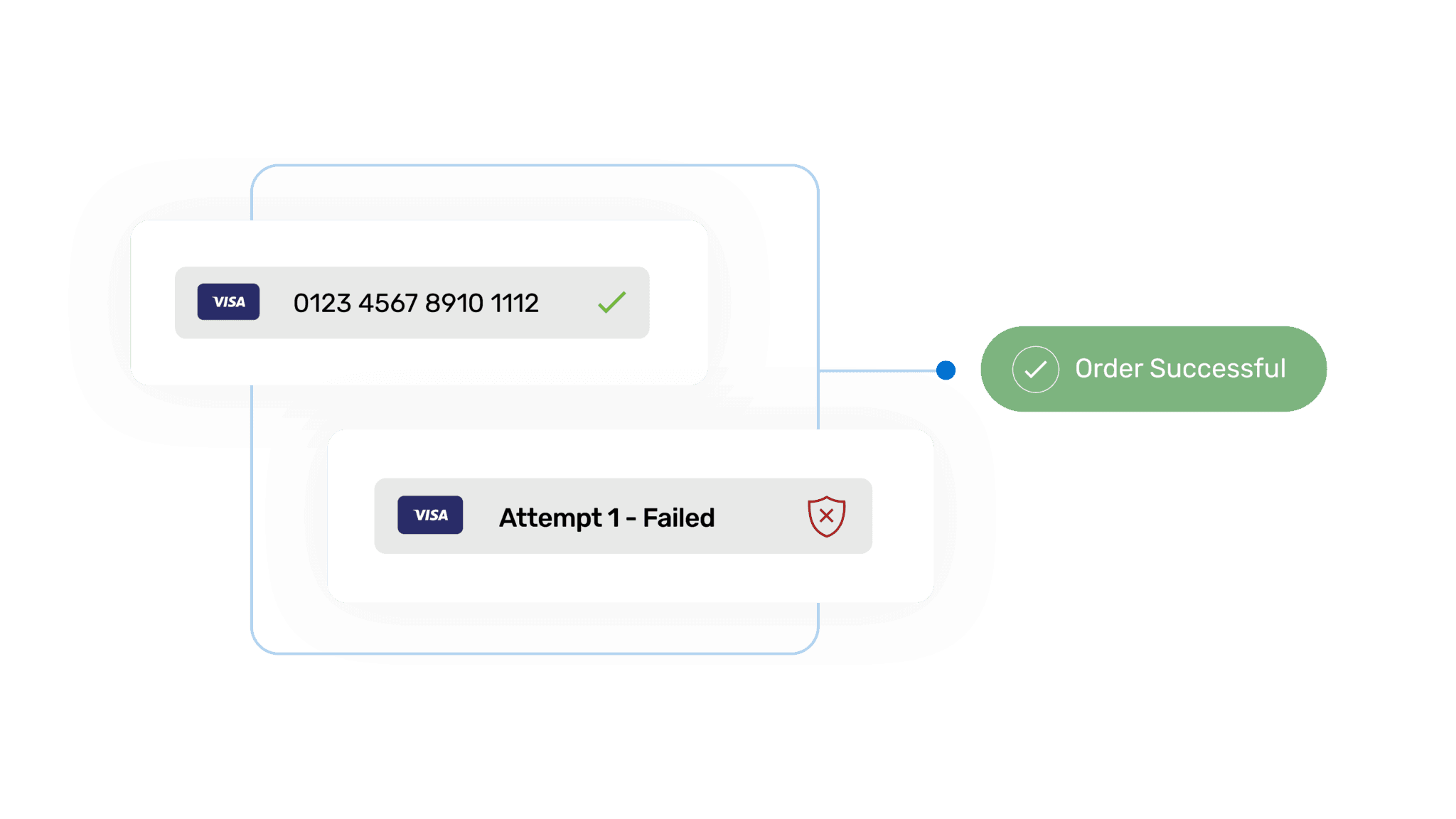

No one likes a declined transaction. An acquirer-agnostic gateway ensures that you're not at the mercy of a single acquiring bank. If one bank doesn't accept the transaction, for whatever reason, or there’s a technical issue, the transaction can automatically be retried with another one. It does this by intelligently routing the transaction based on multiple factors, including country, currency and payment method. It's like having a Plan B that actually works.

Do you dream of expanding your business globally? A payment gateway that is acquirer-agnostic is your passport to international success. It supports multiple currencies and payment methods, giving your customers a seamless, localised experience, no matter where they are. Sourcing a local acquirer doesn’t just improve your acceptance rate, but it can also lower your processing costs.

The business world moves fast, and so should your payment solutions. An acquirer-agnostic gateway is much more scalable so it won’t restrict your business growth. Whether you want to expand internationally or the amount of daily transactions is increasing, this type of payment gateway will grow with you.

An acquirer-agnostic payment gateway is especially beneficial for high-risk businesses. Since these types of businesses are more prone to transaction declines, automatic retries with other acquirers can make all the difference in whether they succeed or not.

Are you considering making the switch and levelling up your payment game? Getting an acquirer-agnostic gateway is easier than you might think. The most important things to consider before making the switch are compatibility, gateway integration and support.

Compatibility is key to a smooth transition, and an easy integration process with the full support of your provider will ensure the process is hassle-free with no interruptions to your processing.

At Nomupay, the best place to start is to contact our payment specialists. They’ll guide you through the whole process and answer any of your questions to ensure we’re the right fit for you.

Our onboarding and integration teams will tackle the rest and get you set up in no time.

So there you have it – the secret sauce to reducing declines and elevating your payment experience. With an acquirer-agnostic gateway, you're not just processing payments; you're future-proofing your business.

If you’re ready to say goodbye to declines and boost your authorisation rates, learn more about how to integrate our payment gateway or get in touch to speak with a specialist.

Additional FAQs to help with your understanding of an acquirer-agnostic payment gateway:

What is an acquirer in payments?

An acquirer (or acquiring bank) is a financial institution that works with businesses to process card payments. When you pay with a credit or debit card, the acquirer makes sure the transaction goes through securely and that the money ends up in the business’s account.