Cross-border payouts can take your business to the next level, but only if they’re done right. Running your payouts inefficiently can cause you to lose money rather than gain – which is less than ideal.

An important factor to understanding is the cost of sending funds internationally and all the moving parts that come with it.

So, let’s take a look at the hidden cost of cross-border payouts to avoid you getting blind-sided by fees, exchange rates and everything in between.

What’s in this blog:

Whether you’re planning to scale your business globally, or you’re already reaching an international audience, cross-border payouts are a fundamental solution that you need to get right, particularly if you’re running a marketplace.

Here are just a few reasons why you should consider payouts as a priority.

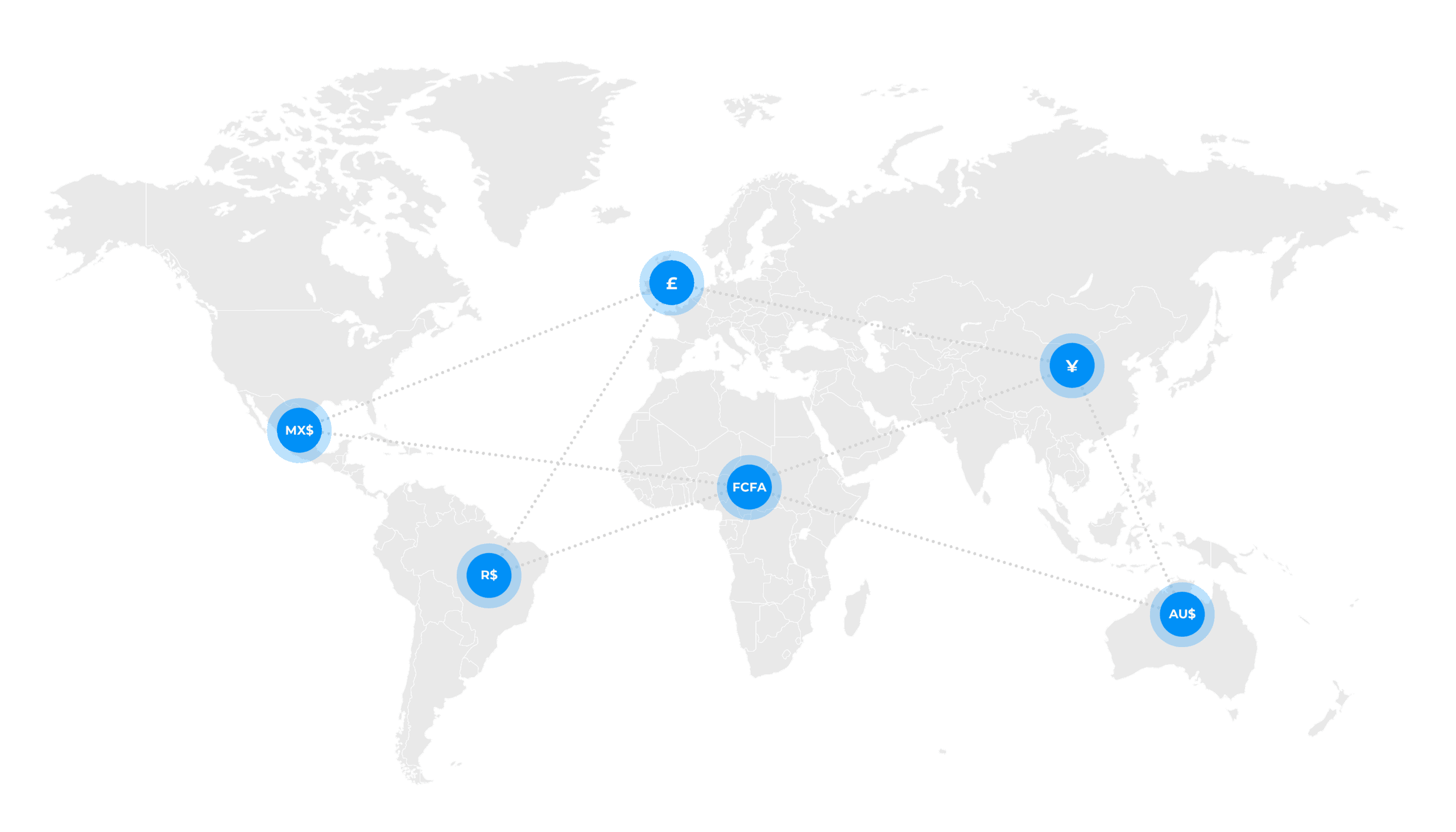

For businesses looking to grow globally, smooth cross-border payouts are key. They make it possible to pay overseas suppliers and reach new markets without unnecessary friction. When you can pay people easily, no matter where you or the recipient is in the world, your business can expand faster and operate more flexibly.

Why restrict yourself with the team you hire! Talent is all over the world, and it’s important to have local expertise in each market you want to expand to. Being able to payout to your international workforce seamlessly is just as important as sending funds to clients.

In today’s digital economy, speed and reliability matter. Companies that offer quick, transparent payouts stand out. Whether you’re an online marketplace, a gig platform or a global service provider, a seamless payout experience can build trust and loyalty among your international partners and customers.

Before you take the plunge and set up cross-border payouts, you need to be aware of the logistics. Considering the following aspects should be included in your strategy.

Foreign exchange (FX) rates can make a big difference to how much your business and your recipients actually receive. Even small fluctuations can add up over time. It’s important to understand how your provider sets exchange rates, and whether they use a mid-market rate (the one you see on Google) or add a margin on top.

Every country has its own financial rules, tax requirements and reporting standards. Staying compliant can be tricky, especially if you’re paying into multiple regions. Working with a payment partner who understands local regulations can save time, reduce risk and help you avoid unnecessary delays or penalties.

Cross-border transfers don’t always move as quickly as domestic ones. Traditional bank wires can take several days, and intermediary banks may charge extra along the way. Newer digital payout solutions, however, can move funds in near real-time and often at a lower cost.

When sending money internationally, there are often more players involved than you might think. Each step in the journey, from your account to the recipient’s, can add a cost, and these fees can quickly add up if you’re not careful.

Here are the main types of charges to look out for:

Understanding where these costs come from helps you make smarter choices. By breaking down the fees and being aware of hidden charges, you can avoid unpleasant surprises and make your payouts more efficient and cost-effective.

The good news is that international payouts don’t have to be expensive. By being proactive and choosing the right tools, you can keep fees manageable and make sure more of your money reaches its destination.

Here are some practical ways to lower your costs:

Ultimately, the best way to lower fees is to stay informed and flexible. The more visibility you have over how and where your money moves, the easier it is to spot opportunities to save — and to make cross-border payouts efficient, transparent and fair for everyone involved.

So, we’ve talked about the benefits of using a specialist provider, but what does that actually mean in practice? The right partner can make all the difference between slow, costly transfers and fast, transparent global payouts that help your business grow.

When comparing providers, look beyond the headline fees. A great cross-border payout solution should offer:

We may be a little biased, but this is exactly where Nomupay fits in. Our payout solution is designed for businesses that want to move money globally without the usual complexity. With a single API and a Unified Platform, you can send payments to multiple markets, currencies and channels, all with transparency and control built in.

Nomupay takes care of the local details so you can focus on what matters most: growing your business and paying your teams, partners or customers quickly and fairly — wherever they are.