From passionate players and global communities to endless digital content opportunities, the gaming industry is an exciting place to be. But when it comes to payments, the fun often stops there.

Despite the rapid growth of the industry, which is expected to reach a global market size of $505.17B by 2030, the payments infrastructure is outdated. This creates a constant battle between the merchant and the financial institutions to keep their merchant account open, manage chargebacks and offer the right payment experience for their customers.

But why?

Let’s take a closer look at the main challenges and why payments in gaming are such a tricky game to play.

What’s in this blog:

Few things are more stressful for a gaming merchant than waking up to find their merchant account frozen. Unfortunately, it happens far too often.

Gaming is often classified as a “high-risk” industry by banks and payment providers. That means even small spikes in transaction volume, unusual traffic patterns or a handful of chargebacks can trigger account reviews or suspensions.

For marketplaces and resellers, this can be devastating, halting payouts, blocking player transactions and damaging trust with your customers.

How to solve this

You can’t change your high-risk label, so the best way to prevent it from impacting your business is by finding a payment provider that is built for your industry. The right partner will have all the right tools to help you minimise the damage often caused by your main pain points, including chargebacks, false declines and lack of APM access.

Chargebacks are a familiar enemy in the gaming space. Fraudulent purchases, friendly fraud and disputes over digital goods all contribute to high chargeback rates.

Because digital items can’t be returned like physical goods can, it’s harder to defend disputes. Also, players (or accounts) may make purchases without proper authorisation, especially in younger gamers, resulting in friendly fraud disputes when the card holder (or likely, the parent) doesn’t recognise the transaction.

Once too many chargebacks hit, merchants face higher fees, penalties or even termination by their processor.

How to solve this

Combating this constant battle requires smart tools and fraud prevention systems offered by a payment partner who understand the unique risks of gaming.

Chargeback alerts are hugely beneficial to ensure you stay on top of disputes and get them resolved before they become a chargeback. But if you want to go one step further to prevent disputes from happening, then clear payment descriptions to avoid confusion on the bank statement, and easy and clear refund policies will help do just that.

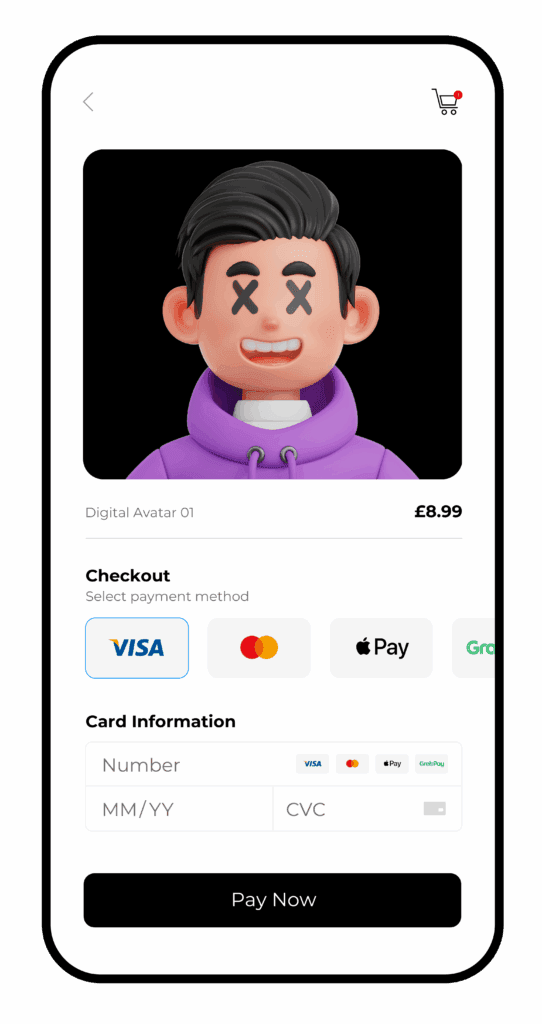

Gamers are global. In fact, there’s ~3.6 billion of them! And they all use different currencies and payment preferences, from local e-wallets to prepaid cards and account-to-account transfers. But not every bank or payment processor is ready to support that diversity.

Due to the industries high-risk label, many gaming merchants find themselves restricted to a few “safe” payment methods, which can cut off huge chunks of potential customers. If your customers can’t pay the way they want to, they’ll simply move on to a competitor who lets them.

This lack of APM access makes it harder to scale internationally, especially in high-growth markets like Southeast Asia or Latin America where local payment options dominate.

How to solve this

Offering more than the traditional methods, even if it’s just one or two APMs, will go a long way. By adding one additional method, you could increase your revenue by 12%!

By focusing on the markets your target gamers are based will help you decide which APMs to fight for. For example, if you’re based in Hong Kong, you’ll need to offer AliPay, but if you’re processing in Malaysia, then GrabPay is a must. Find a payment provider that can give you access to these APMs.

Hint: We offer more than 200 APMs, even to our high-risk merchants!

Fast-paced, high frequency microtransactions are pretty typical in gaming. But, unfortunately, these transactions can often be treated as suspicious.

This leads to false declines.

When a gamer is mid-game and tries to purchase something (skins, virtual currency, etc.), a declined payment breaks the flow. Gamers expect instant gratification and smooth experiences. A friction point can disrupt immersion, ruin the moment and lead to churn or abandonment.

How to solve this

When dealing with one acquirer, payment declines can occur more often. But when you use multiple acquirers, particularly local acquirers, you can reduce this risk greatly by having declined transactions re-routed until the transaction is a success.

In fact, you could boost your approval rates to 97%+ by opting for local acquiring for cross-border transactions. Find a payment provider, like Nomupay, that will help you access a global network and keep your gamers payment experience smooth.

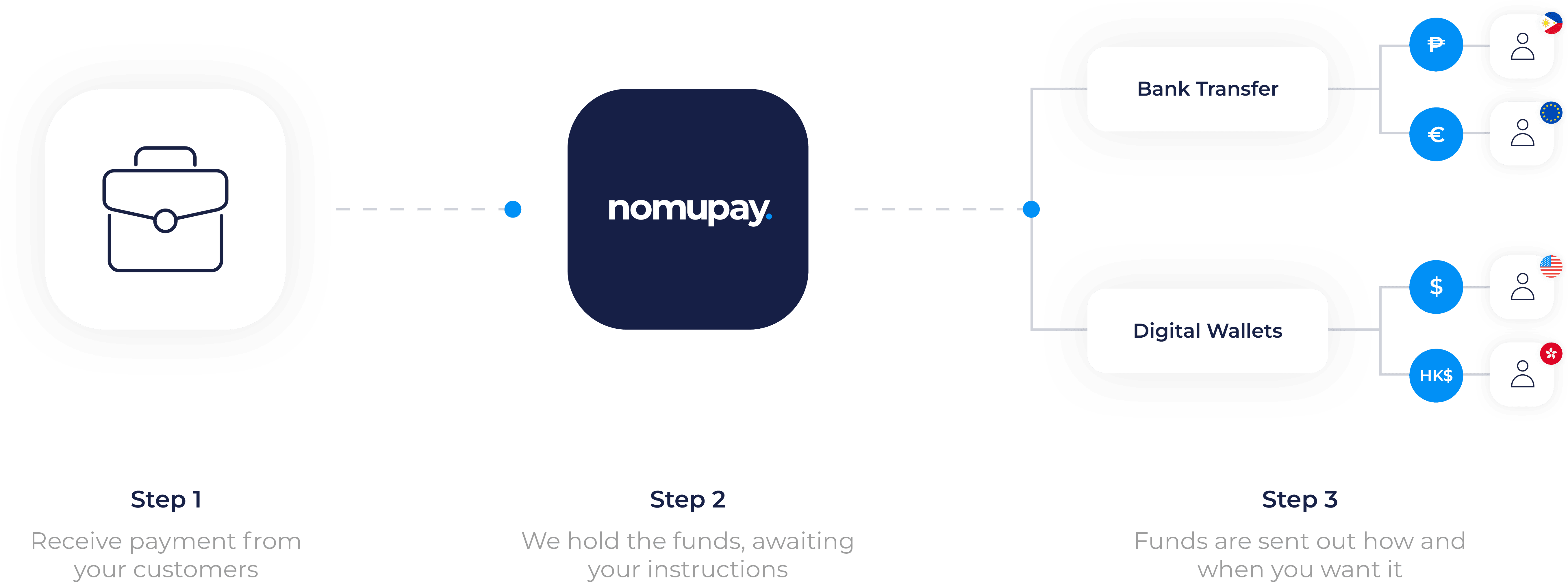

If taking payments is one challenge, sending payouts can be an even bigger one — especially for gaming marketplaces and reseller platforms.

In gaming ecosystems, payouts are constant. Sellers, creators and affiliates expect fast, reliable payments, often across multiple countries, currencies and payout methods. But most payment systems weren’t built for that kind of complexity.

Delays in payouts can damage reputation and trust. Long settlement times or limited payout options frustrate sellers and partners, while manual payout processes drain time and resources from your operations team.

How to solve this

You need a payout partner that is built for marketplaces. A solution that gives you all the control so you can direct when, how much and via which method the payout happens. For example, if you need to send funds to one account via bank transfer and another to an e-wallet, you need to be able to make that happen.

To thrive, gaming businesses need a payment partner who truly understands the industry’s pace and complexity. That means:

If you’re interested in seeing how we can provide all of this and help you overcome the typical challenges that gaming merchants face, get in touch.