There are many moving parts that a marketplace needs to manage effectively to succeed – payouts being a huge part of that!

A study reported that 56% of sellers are willing to switch to a marketplace offering faster payouts. So if you’re treating payouts like a backend process rather than part of your strategy to have a competitive edge over the competition, you could end up losing out.

Let’s take a look at the key challenges payouts can bring a marketplace and how to overcome them.

What’s in this blog:

Regulation is one of the biggest hurdles in any marketplace payout flow, and it only grows as you scale. KYC and KYB checks must be handled correctly to prevent fraud and meet local rules. AML screening needs to run continuously, not just at onboarding. Tax obligations differ across regions and financial authorities regularly update what they expect from platforms handling money.

The difficulty isn’t simply “ticking boxes”. It’s the never-ending nature of it. Regulations shift, territories have unique interpretations and a process that works in one country might be non-compliant in another. For many marketplaces, this becomes a maze of manual checks, duplicated effort and constant worry about whether something has been missed.

How to tackle this:

The best way to achieve this? Local experts who understand the market. They need continuous, proactive systems in place to adapt to the new rules, local laws and changing risk profiles.

By using a global payments provider, like Nomupay, who have specialists on the ground across Europe, MENA and Southeast Asia, you’ll have a team on your side helping you stay up to date with regional insights and implement the rules and systems you need to keep the regulators happy.

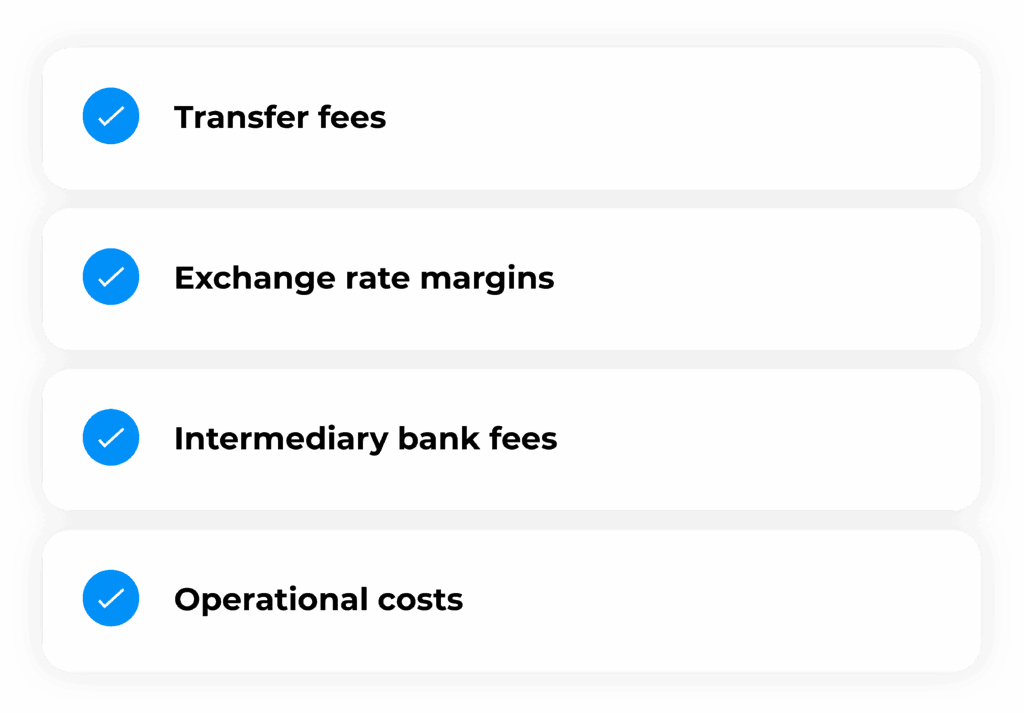

If you’re not careful, payout fees can get out of control. Each step throughout the payout flow can incur a cost, including transfer fees, exchange rate margins, intermediary fees and operational costs. And when you’re running thousands or millions of transactions, especially when funds are being sent overseas, these costs will add up!

What makes it a challenge is the lack of transparency. Costs are often scattered across providers, banks, FX partners and internal systems. Without proper visibility, margins slowly shrink, and teams only realise when it’s already become a strategic issue.

How to tackle this:

The more players involved, the more you have to pay out, so keeping operations as simple as possible with limited systems taking a cut, will only benefit your revenue. Using a payment provider that offers the whole package, from mass payment acceptance and payouts to reporting and fraud management, you can reduce operational costs and have all your invoices in one place for complete transparency.

Sending funds in local currencies can help to tackle FX fees, as well as provide a smoother experience for the recipient.

For a full rundown of payouts and their fees, check out our blog: The hidden cost of cross-border payouts.

For international marketplaces, FX is a daily reality. Exchange rates move up and down constantly, and even small fluctuations can have a big impact on seller earnings. That volatility not only affects cash flow but also trust. If payees don’t understand how rates are calculated or feel shortchanged, frustration builds.

Additionally, the FX component isn’t just about rates: there are timing issues (when to convert), strategies (hedging, multi-currency balances) and communication challenges (explaining to sellers why their final payout differs from expectations). This complex mix is difficult to manage, especially at scale.

How to tackle this:

Marketplaces can ease the impact of currency volatility by offering multi-currency balances so sellers can choose when to hold or convert funds, locking in FX rates at the moment of transaction to provide certainty and a smoother experience.

Working with providers that not only have access to a range of currencies, but also offer competitive and transparent pricing to avoid unexpected costs can be invaluable in such a volatile industry.

Fast payouts are no longer a “nice to have”. For many sellers, they are essential. For small sellers or gig workers, delayed payouts can be crippling; cashflow can make or break their ability to operate.

Traditional banking rails, especially cross-border, simply aren’t designed for speed. Intermediaries introduce delays. Fraud checks extend timelines. Lack of flexibility creates friction. Speed isn’t just a convenience; it’s a competitive necessity.

How to tackle this:

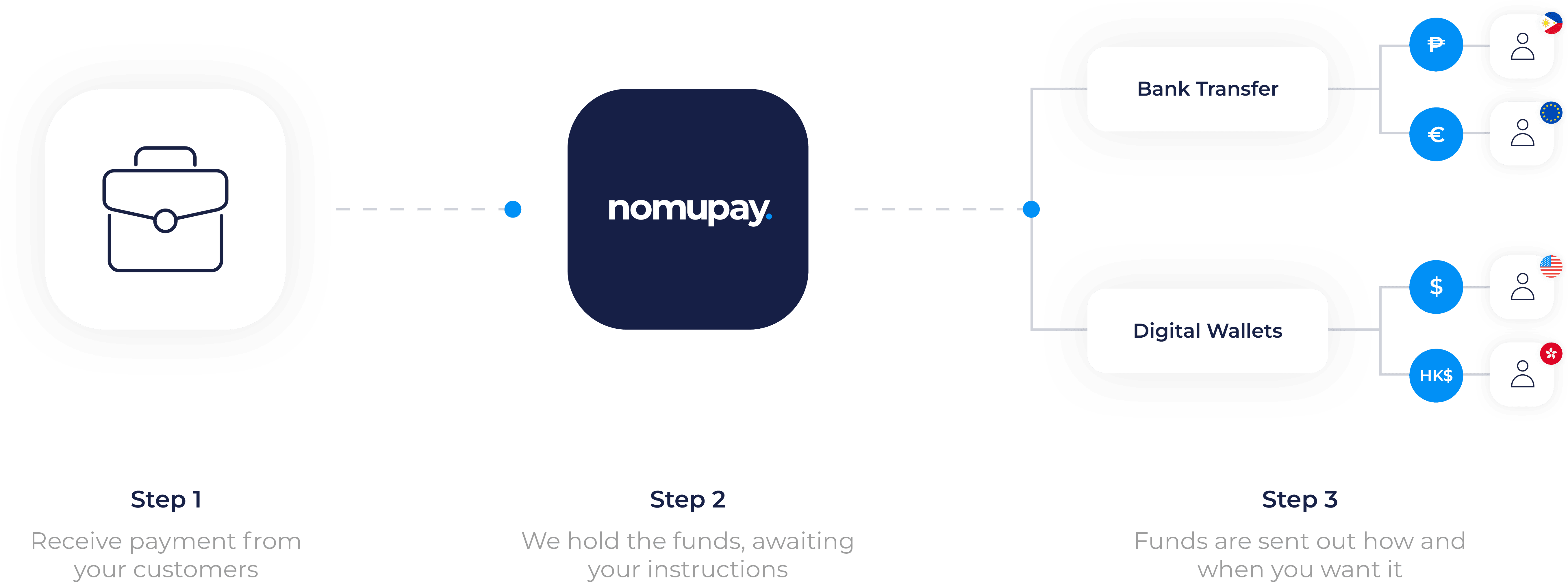

The fastest way to settle funds is to use local payment rails, local currencies and digital wallets. By relying on a global platform with direct access to local acquirers, you simplify the process and avoid the intermediary banks that often introduce delays. Using local currencies further reduces FX-related hold-ups, and local payment methods help bypass the slow processing times of traditional banks so your funds can reach its recipient quicker and smoother.

Marketplaces thrive on openness. Anyone can sign up from professional sellers to one-off freelancers, start selling and get paid. Unfortunately, that also makes them ideal targets for fraudsters, including fake sellers, stolen identities, account takeovers, chargeback abuse and money laundering.

Fraud becomes especially dangerous at the payout stage. Once funds have left the platform, they’re notoriously difficult to recover. Marketplaces often rely on manual reviews or outdated tools, which can be both slow and ineffective. The constant balancing act between blocking bad actors and maintaining a smooth experience for legitimate sellers is one of the hardest operational challenges in the industry.

How to tackle this:

To tackle fraud effectively, marketplaces need a proactive approach that blends strong identity verification with real-time monitoring. Thorough KYC and KYB checks at onboarding help prevent bad actors from entering the system, while ongoing behavioural analysis and transaction monitoring can flag suspicious patterns before payouts are released.

Behind the scenes, many payout processes are held together by spreadsheets and legacy workflows. But as volume grows, complexity grows too. What worked for 500 sellers completely falls apart at 50,000.

Without strong systems in place, manual tasks like chasing missing bank details, resolving failed payments, re-issuing payouts and managing exceptions become an operational headache. These tasks not only waste time but also introduce risk with human error. As your marketplace grows, this manual complexity can become a serious bottleneck.

How to tackle this

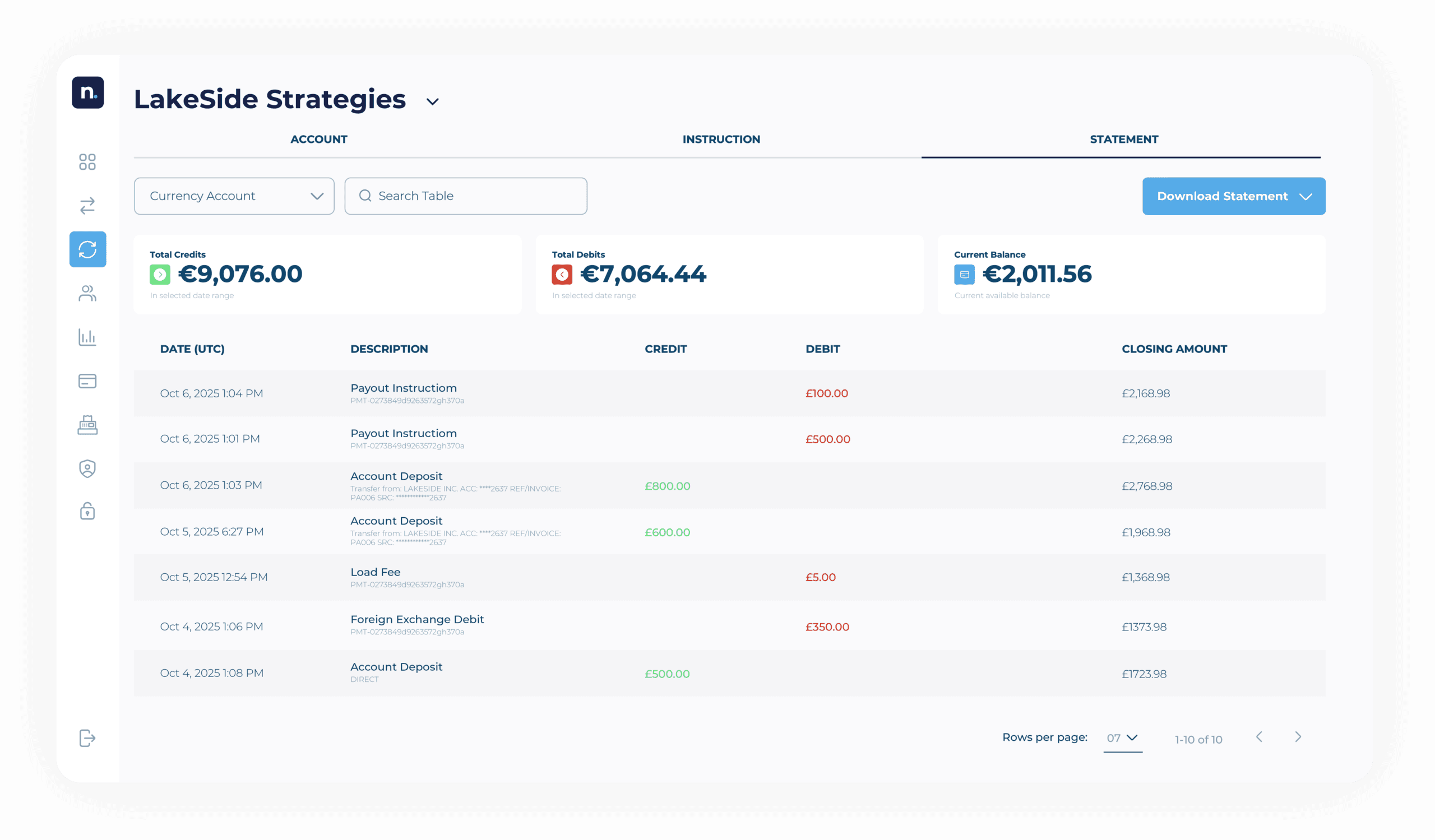

The key to reducing operational complexity is automation and consolidation. By replacing manual reconciliation and data entry with automated workflows, marketplaces can cut errors and free up teams to focus on higher-value tasks. Using a single, unified payout platform also reduces fragmentation across systems, streamlines reporting and makes it easier to manage global payouts at scale. Together, these steps turn a previously time-consuming process into one that runs smoothly and efficiently.

For sellers, payouts are more than just another payment solution; they’re the crux of their business, meaning it’s a huge trust moment that proves whether your platform is right for them or not. A confusing fee, an unexpected delay or a failed payout can undo months of relationship-building.

Marketplaces increasingly differentiate themselves on experience, and payout experience is a major part of that. Sellers expect transparency, predictability and control. When they don’t get it, they naturally question whether your platform is the right place for them to build their business.

How to tackle this:

Clear communication, flexible payout options, multi-currency balances and transparent fee structures all contribute to a smoother, more trustworthy experience. It’s easier said than done, but if you can provide all of this, then you’re on to a winner.

With the help from a payment provider, creating this seamless experience can become a whole lot easier. That’s why choosing the right payment partner is so important.

One of the biggest steps in overcoming all of these challenges is finding the right payment partner who can support global marketplace payouts.

When looking for a PSP, the key things to consider include:

Choosing the right PSP can transform payouts from a constant challenge into a competitive advantage. If you’re looking for a partner designed specifically to help marketplaces grow across borders with simplicity and confidence, Nomupay delivers the local access, flexible and speedy experience, and unified solutions needed to make global payouts seamless.

Check out our payouts page for all the details.