As your platform scales, paying out to multiple recipients becomes one of the most complex and time-sensitive challenges you’ll face. Whether you’re running a marketplace, gig economy app or booking platform, managing who gets paid, how much and when is no small task.

The good news? Setting up a reliable mass payout system doesn’t have to be complicated. With the right setup and tools, you can automate most of the payout process, keep compliance under control and deliver a seamless experience for your users.

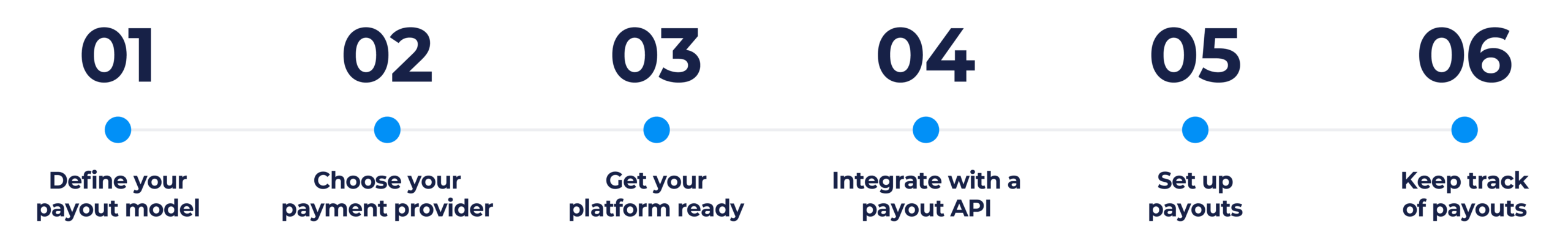

Here’s step by step how to set up payouts, from building the foundations to running your first automated payout batch.

What’s in this blog:

Before you integrate anything, take time to map out how payouts will work on your platform. The key questions to answer are:

These decisions impact your compliance obligations, user experience and technical design. The more flexibility you have, such as offering users a choice of payout methods or timing, the better.

Once you’ve defined your payout model, the next step is selecting a provider that can support it. Not all payment partners are built for mass payouts, especially if you want full control of them, so look for one that fits your specific needs.

Here are a few key things to consider:

Geographic coverage: Does the provider support payouts in all the countries you serve?

Payout methods: Can it handle both bank transfers and e-wallets, or just one?

Currency support: Will you be able to send funds in multiple currencies without heavy conversion fees?

Compliance and security: Does the provider manage KYC/AML checks for you, or will your team need to handle that?

API capabilities: Is there a developer-friendly API that can integrate easily with your existing systems?

Flexibility is the real differentiator. Some providers limit how long you can hold funds or how you manage disbursements. A platform like Nomupay, for example, gives merchants full control, allowing them to hold funds as long as needed and release them when and how they choose. This type of adaptability ensures that your payout process aligns perfectly with your business model.

Why not take a look at our payout solution to see if it will suit your needs?

Now, the following steps, we can only advise on our own flow, so we’ll take you through how to get set up with Nomupay.

Once you’ve chosen your payment provider (in this case, us), you’ll need to get the essentials set up or prepared to make the payouts possible.

You’re now ready to integrate! Once we’ve sent you your API credentials, the following steps will occur:

“Testing your payout flow is probably the most important step in the whole process. It provides valuable time to ensure you’re comfortable with using the API, raise any queries or concerns with the team and flag any issues before you go live. And we’ll be here to support you every step of the way!” – Robbie Wilder, Head of Integrations

Once your payout system is up and running, it’s time to set up the payout transactions. Through the payouts API, you can create instructions to tell us how much, when and via which payout method (bank transfer or e-wallet) you want your funds to be sent.

You can also create logic to set up automations for a much more seamless approach.

Setting up your payouts doesn’t end there. It’s important to monitor transactions, instructions and your available balance so you can track the progress of every payout and stay on top of any issues that occur.

Luckily, you can do all this via the Payouts dashboard in your Unified Platform.

Building a scalable payout system isn’t just about moving money; it’s about building trust, reliability and operational efficiency. By mapping your payout model, choosing the right partner, integrating a flexible API and automating smartly, you can streamline your operations and give your users the confidence that they’ll always get paid on time.

And when you’re ready to bring both pay-ins and payouts together under one seamless system, Nomupay can help you manage it all — securely, globally and on your terms.