Selling to international customers has never been more attainable. From e-commerce stores reaching customers worldwide to B2B companies managing global supply chains, the opportunities for merchants have completely opened up.

But growth and opportunity does bring more obstacles to overcome.

Cross-border payments are at the heart of international commerce, but between FX fees, currency conversion and compliance checks, they are often more challenging than they seem. For merchants, understanding how they work, what challenges they present and what solutions exist is essential for scaling globally. This blog breaks down everything you need to know.

What’s in this blog:

Cross-border payments, or international payments, are transactions that are sent from one country and received in another. These payments can occur within all industries including retail, travel, local authorities and even peer-to-peer transfers.

For example:

Unlike domestic payments, cross-border transactions involve different banking systems, currencies and regulations, all of which can add cost and complexity for merchants.

Alternatively to international payments, domestic payments are when both the buyer and the merchant are in the same country. These transactions are much more straightforward, with less banking systems and fees involved, but you can be limiting your business if you can only process domestic payments.

| Factor | Domestic payments | Cross-border payments |

| Location | Buyer and merchant are in the same country | Buyer and merchant are in different countries |

| Currency | Single currency | Involves at least one currency exchange |

| Banking systems | Processed within one national payment system | Multiple banking systems involved; often requires correspondent banks |

| Speed | Usually near-instant or same-day | Can take 2–5 business days depending on method |

| Fees | Low or minimal (domestic bank/card fees) | Higher due to FX conversion, correspondent bank fees, and compliance checks |

| Regulation | Governed by local/national laws only | Must comply with multiple jurisdictions (AML, KYC, tax rules) |

| Complexity | Straightforward | Higher complexity; more intermediaries involved |

| Merchant impact | Lower cost, faster settlement, predictable | Higher cost, slower settlement, FX risk, more admin overhead |

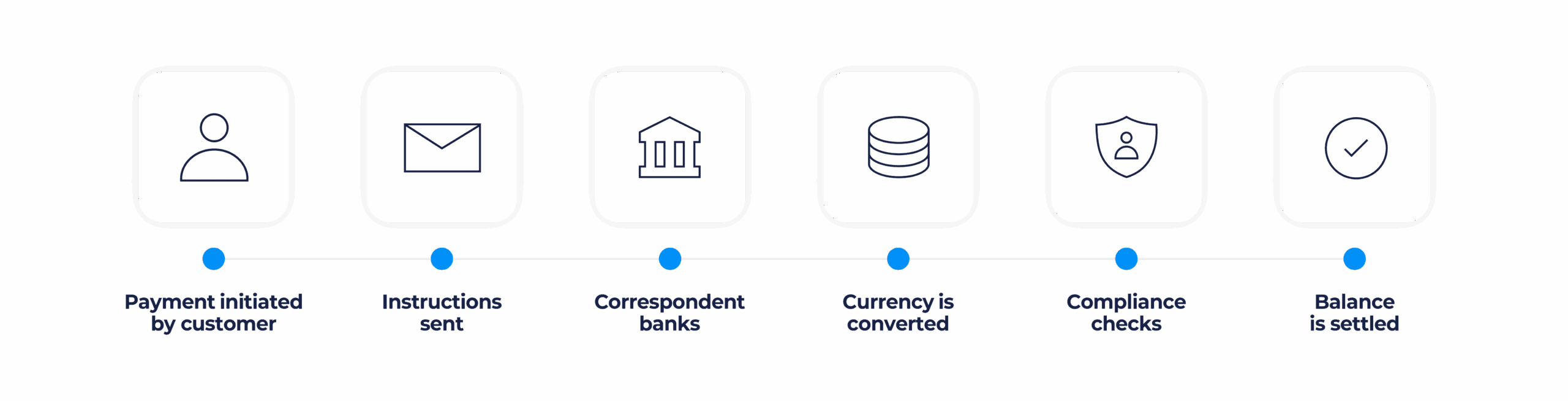

Cross-border payments may seem instant to the customer, but behind the scenes they are more complex.

Since domestic payment systems don’t connect across borders, banks use other banks in different countries (called correspondent banks) to help move money internationally by holding accounts on their behalf.

Correspondent banks act as intermediaries between institutions that don’t have a direct relationship, ensuring payments can still reach their destination, but at the cost of extra time and FX fees.

Here’s a simplified breakdown:

For merchants, this process can introduce delays, fees and foreign exchange (FX) risk, all of which directly impact margins and cash flow. This complexity means it’s critical to choose a payment provider that can streamline these steps behind the scenes.

When selling internationally, the payment methods you offer can make or break a sale. While card payments and global wallets are popular in some regions, customers in other countries strongly prefer local payment methods. For merchants, adapting to these preferences will greatly reduce cart abandonment and build trust with buyers.

Here’s why local payment methods matter:

For merchants, the lesson is clear: a “one-size-fits-all” approach to payments won’t work globally. To succeed in cross-border commerce, you need to tailor your payment offering to the preferences of each target market.

As we’ve already alluded to, cross-border payments are a must if you want your business to expand globally, however, merchants face unique challenges when accepting or making international payments.

These include:

These global payment challenges can create friction in scaling internationally if not addressed with the right solutions. For a more in-depth discussion on this topic, take a look at our blog that covers navigating global payment gateway challenges.

The solution? Local acquiring!

Timeframes matter when running a business. Here’s what merchants can expect:

Delays in receiving funds can impact cash flow, making settlement speed a critical factor for merchants choosing payment partners.

Exchange rates don’t stay still. They rise and fall in response to global market conditions. For merchants, that means the amount you ultimately receive (or pay out) can shift from day to day. Therefore, it’s advised to closely monitor exchange rates if you’re processing cross-border transactions.

The biggest way you can reduce the risk of cross-border payments is by using a reputable payments provide that has access to the markets you want to process in. You’ll want a PSP that is:

Looking to simplify cross-border payments? Nomupay helps merchants expand globally with local acquiring and tailored payment solutions. Arrange a call to see how we can improve your international processing and scalability.