Buy Now Pay Later (BNPL) has become such an integral part of the e-commerce world. The popular payment method has continued to rise over the years, offering consumers the financial freedom they’ve now come to expect. It’s become so fundamental to the way consumers shop that 40% of shoppers will even postpone their purchase if BNPL isn’t an option.

And it’s growth doesn’t stop here. It’s predicted to

Younger shoppers are driving BNPL’s rise, preferring short-term, manageable installments over the long-term commitment of traditional credit. As much as 44% of US Gen-Z shoppers prefer its flexibility over credit cards.

From the merchant viewpoint, BNPL presents an attractive proposition, accelerate towards 900 million global users by 2027!

So, if it’s not a part of your checkout flow yet, why not? Let’s take a look at the key drivers for BNPL’s success.

What’s in this blog:

Low risk, high reward

not just as a payment option, but as a strategic tool for acquisition, increased order value and conversion uplift.

It is often seen as less risky than extending credit themselves, because the BNPL provider typically takes on the risk themselves. You, as the merchant, will benefit from receiving the full payment upfront while offering customers flexible installments, reducing financial exposure and simplifying cash flow management.

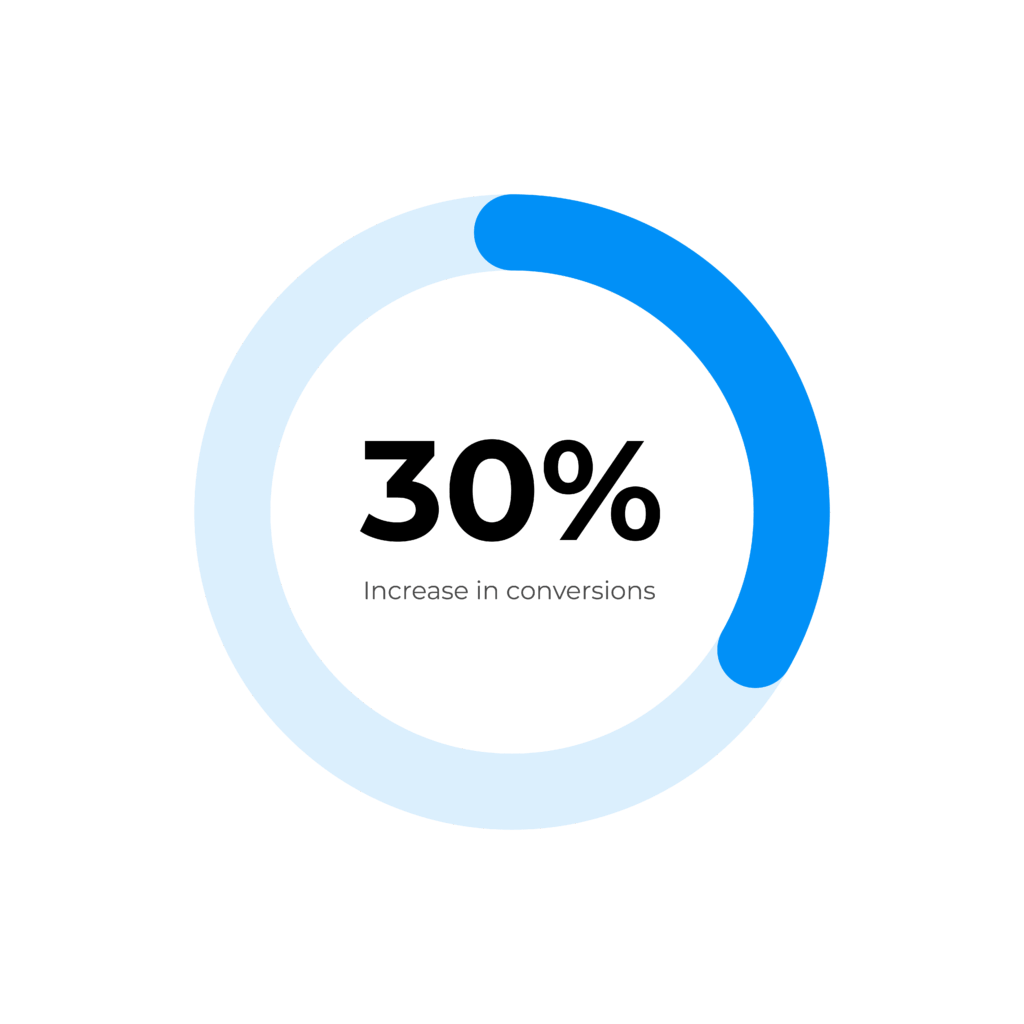

In addition to smoothing the checkout process, the availability of BNPL options in e-commerce stores have shown an increase in customer loyalty and conversions wherein sales have increased by up to 30%.

With the draw of paying for purchases over time or via installments, customers are going beyond making that first initial buying decision and are increasing their average order value by 20-40%.

In fact, in Asia-Pacific, BNPL accounts for approximately 36.4% of global provider revenue. That’s huge for a single payment method!

With multiple BNPL options available to consumers through the likes of Klarna, Clear Pay, Affirm and PayPal's pay in 3 (UK) option, these payment methods are increasingly becoming the standard at checkout.

It enforces convenience, which is now an expectation, alongside auto-fill and real-time validation, with 76% of consumers saying a smooth checkout is very influential when choosing a merchant.

BNPL acts as a one-click checkout option for shoppers that either don't have the immediacy of funds or aren't willing to submit payment information across numerous sites. Ultimately, BNPL sits as a contender alongside of, and works with, e-wallet fast payment options, to provide a convenient and speedy way of checking out.

The demand for alternative payment methods is there, with BNPL being just one sector of this massively increasing market. In the UK alone, 61% of consumers say they are more likely to shop with a retailer offering BNPL. That’s a huge market you could be missing out on if you decide against offering it.

Consumers actively try to avoid entering their payment details online, surging the push for faster payment journeys and a streamlined checkout process. They will even abandon their shopping cart if you don’t meet these expectations. In the US, 18% of online shoppers abandoned an order solely because of a too long / complicated checkout process.

The statistics speak for themselves. Offering BNPL as an alternative payment option at checkout can be hugely beneficial to your business, increasing customer loyalty and boost conversions.

Are you ready to add BNPL to your checkout? Get in touch!