Gaining access to consumers all over the world has never been easier thanks to the growth of global e-commerce and increased online activity. But, although reaching international audiences is now possible, you still need to have the right fundamentals, ensuring the online payment process is smooth, to truly gain global growth.

That’s where a global mokėjimo vartai yra.

Without it, you may see a leidimų skaičiaus sumažėjimas, which won’t do your reputation, your customer’s experience or your bottom line any good.

So, if you’re planning to scale internationally and explore new markets, choosing the right international payment gateway provider is key to handling cross-border transactions smoothly.

In this blog, we’ll explore the basics of the payment gateway for global processing, its benefits and what to look for when selecting the best payment gateway for your website.

Kas šiame straipsnyje?

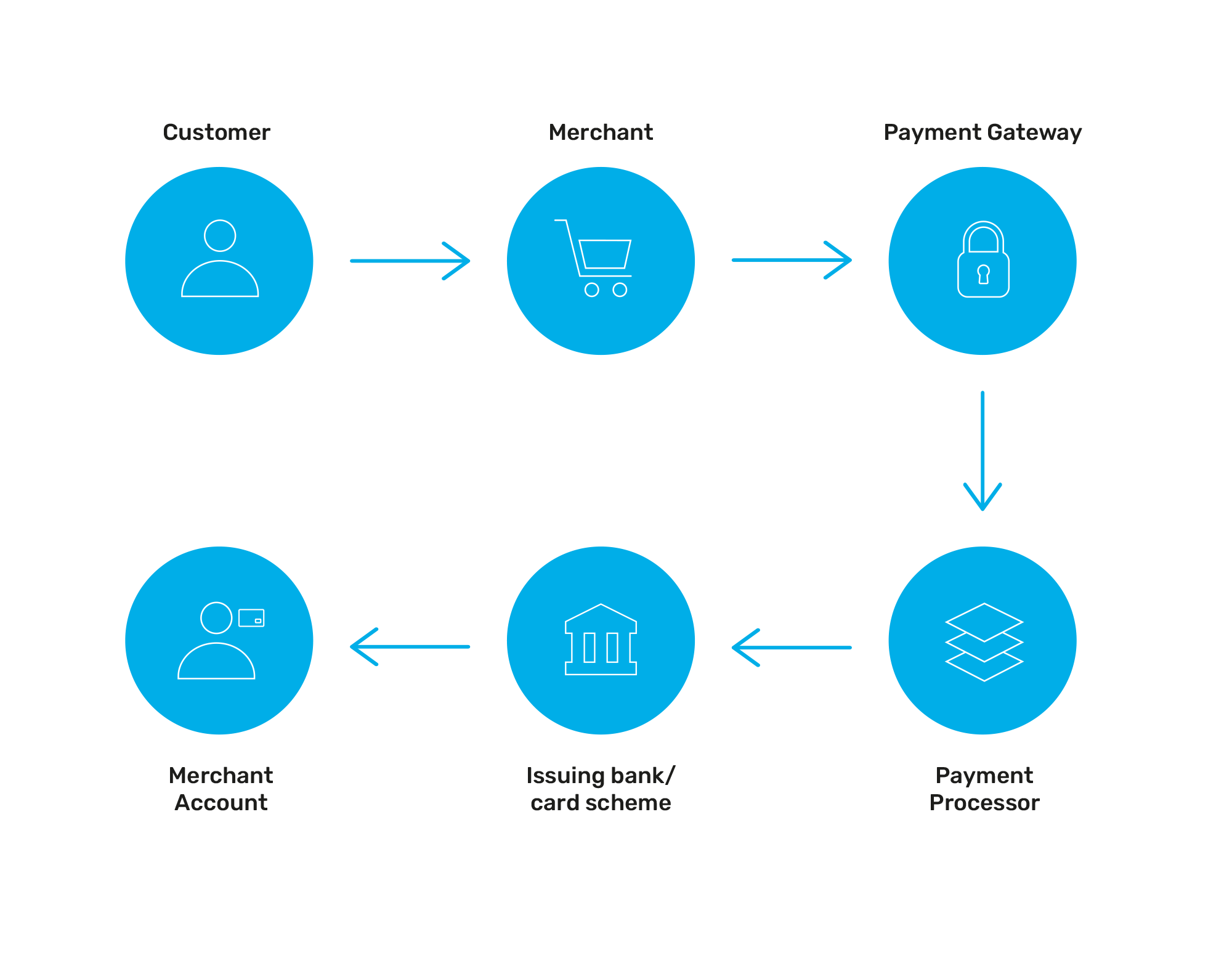

Just like a generic payment gateway, a global payment gateway is the bridge between your online store and the financial institution that processes your international customers' payments. It securely authorises credit card transactions and ensures that funds are transferred from your customer's account to yours.

What sets a payment gateway for international payments apart is its ability to:

Choosing a pasauliniai mokėjimo vartai with a strong network of international acquirers improves authorisation rates, reduces fees and removes friction from the customer journey to help you break through any international barriers and priimti tarptautinius mokėjimus..

Let’s break down the steps involved in processing international transactions through a payment gateway:

If you’re looking to future-proof your business, upgrading your payment gateway to accept global payments may be the right choice. Let’s take you through the benefits to see how an international payment gateway can help:

With an international payment gateway, you can accept payments from customers worldwide, regardless of currency or location. This opens up a whole host of opportunities to tap into new markets and diversify your consumer base that may not have been accessible otherwise. By eliminating barriers related to payment processing overseas, businesses can attract customers from anywhere in the world.

Accessing global markets means accessing more potential customers. The ability to accept international payments in multiple currencies and from various regions enables businesses to capitalise on international sales opportunities. This can result in increased revenue streams and overall business growth.

In today's interconnected world, businesses need to compete, not just locally, but globally. An online payment gateway for international customers gives businesses a competitive edge, enabling them to offer seamless payment experiences worldwide. This can set them apart from competitors who may not have the same level of international payment capabilities.

Global payment gateways are designed to handle high volumes of transactions, making them scalable solutions for businesses looking to grow internationally. Whether a business is processing a handful of cross-border orders or thousands per day, an international payment gateway can accommodate the scalability needs of businesses as they expand into new markets.

Pasauliniai mokėjimo vartai dažnai turi pažangias saugumo funkcijas, kad apsaugotų jūsų klientų mokėjimo informaciją ir sumažintų sukčiavimo riziką. Pavyzdžiui, mūsų "Nomupay" vartai turi sukčiavimo rinkinys 120 sukčiavimo įrankių, įskaitant įspėjimus apie grąžintinas sumas, 3DS2 autentiškumo nustatymas, AVS patikros ir išmaniosios aptikimo priemonės.

Dauguma pasaulinių mokėjimo vartų taip pat turi patogias informacines lenteles, kuriose galite stebėti operacijas, valdyti ginčus ir lengvai rengti ataskaitas. Mūsų Vieninga platforma prietaisų skydelis leidžia analizuoti realaus laiko įžvalgas ir kurti pasirinktines ataskaitas, kad galėtumėte pastebėti elgsenos tendencijas ir priimti protingesnius verslo sprendimus.

Dabar, kai jau suprantate, kaip jie veikia, galbūt svarstote, kuris iš jų yra geriausias pasaulinių mokėjimo vartų teikėjas jūsų verslui. Štai keletas veiksnių, į kuriuos reikėtų atsižvelgti:

Visą sąrašą rasite mūsų tinklaraštyje apie į ką atsižvelgti renkantis mokėjimo vartus.

Įmonėms, norinčioms plėstis tarptautiniu mastu ir priimti mokėjimus iš klientų visame pasaulyje, labai svarbu turėti pasaulinius mokėjimo vartus. Suprasdami, kaip tai veikia, ir pasirinkę tinkamą paslaugų teikėją, galite supaprastinti mokėjimo procesą, padidinti pardavimus ir suteikti geresnę patirtį savo klientams.

Jei esate pasiruošę plėsti savo verslą ir atverti naujas rinkas, dabar gali būti puikus metas peržiūrėti naudojamus mokėjimo vartus. Norėdami sužinoti daugiau apie tai, kaip galime padėti jums plėstis, susisiekite su vienu iš mūsų specialistų.

To recap, here’s an overview of the top FAQs about global payment gateways

Which is the best payment gateway for international transactions?

The best international payment gateway depends on your business needs. Look for providers that offer multi-currency support, access to local acquirers, low transaction fees and excellent fraud prevention tools.

What is an international card payment gateway?

It’s a payment solution that lets businesses accept global card payments, supporting various card networks like Visa, Mastercard and local payment options.

How do I choose the best international payment gateway for my website?

Look for seamless integrations, currency compatibility, strong security features and transparent pricing.