Gaining access to consumers all over the world has never been easier thanks to the growth of global e-commerce and increased online activity. But, although reaching international audiences is now possible, you still need to have the right fundamentals, ensuring the online payment process is smooth, to truly gain global growth.

That’s where a global pasarela de pagos entra.

Without it, you may see a disminución de los porcentajes de autorización, which won’t do your reputation, your customer’s experience or your bottom line any good.

So, if you’re planning to scale internationally and explore new markets, choosing the right international payment gateway provider is key to handling cross-border transactions smoothly.

In this blog, we’ll explore the basics of the payment gateway for global processing, its benefits and what to look for when selecting the best payment gateway for your website.

¿Qué contiene este artículo?

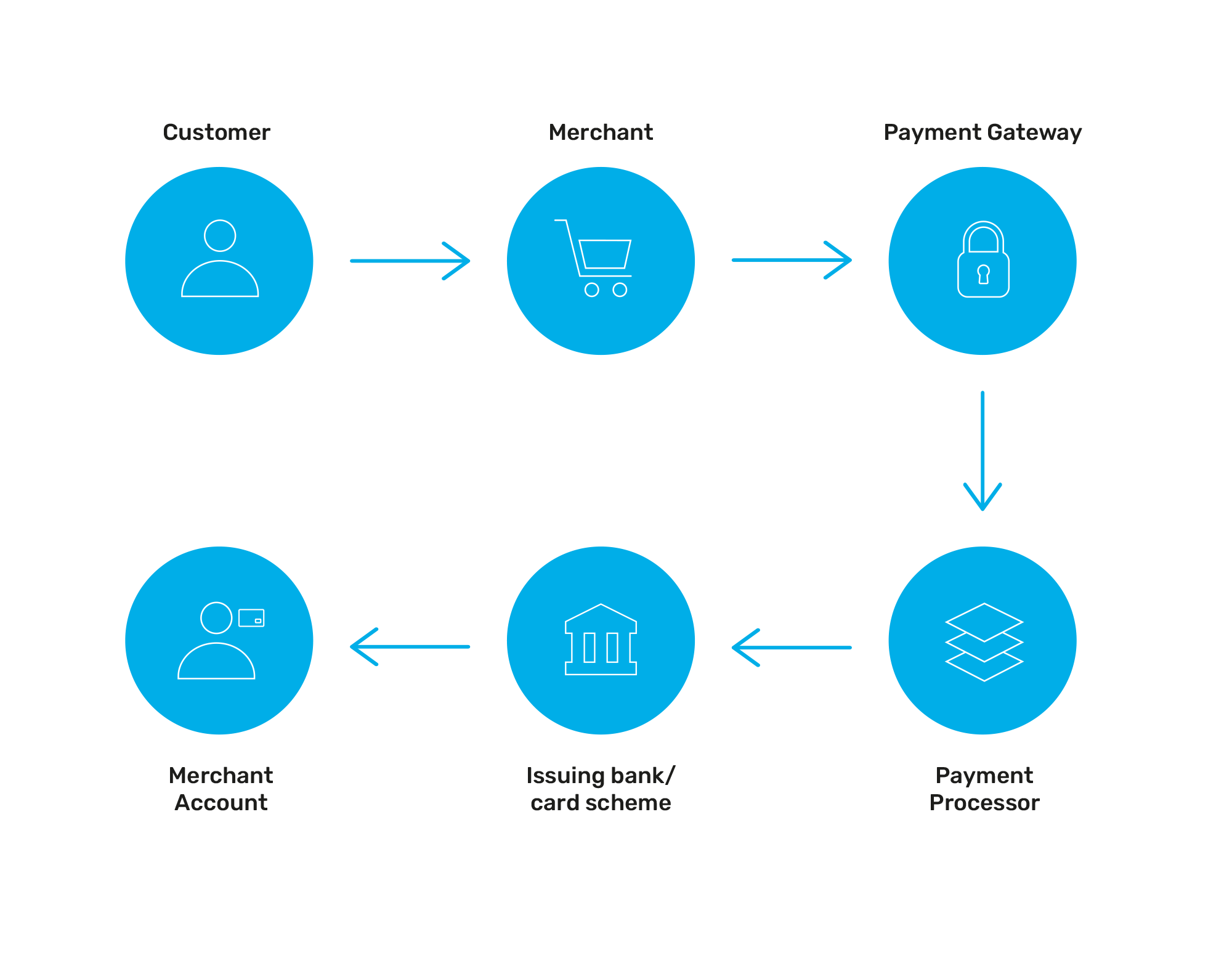

Just like a generic payment gateway, a global payment gateway is the bridge between your online store and the financial institution that processes your international customers' payments. It securely authorises credit card transactions and ensures that funds are transferred from your customer's account to yours.

What sets a payment gateway for international payments apart is its ability to:

Choosing a pasarela de pagos mundial with a strong network of international acquirers improves authorisation rates, reduces fees and removes friction from the customer journey to help you break through any international barriers and aceptar pagos transfronterizos.

Let’s break down the steps involved in processing international transactions through a payment gateway:

If you’re looking to future-proof your business, upgrading your payment gateway to accept global payments may be the right choice. Let’s take you through the benefits to see how an international payment gateway can help:

With an international payment gateway, you can accept payments from customers worldwide, regardless of currency or location. This opens up a whole host of opportunities to tap into new markets and diversify your consumer base that may not have been accessible otherwise. By eliminating barriers related to payment processing overseas, businesses can attract customers from anywhere in the world.

Accessing global markets means accessing more potential customers. The ability to accept international payments in multiple currencies and from various regions enables businesses to capitalise on international sales opportunities. This can result in increased revenue streams and overall business growth.

In today's interconnected world, businesses need to compete, not just locally, but globally. An online payment gateway for international customers gives businesses a competitive edge, enabling them to offer seamless payment experiences worldwide. This can set them apart from competitors who may not have the same level of international payment capabilities.

Global payment gateways are designed to handle high volumes of transactions, making them scalable solutions for businesses looking to grow internationally. Whether a business is processing a handful of cross-border orders or thousands per day, an international payment gateway can accommodate the scalability needs of businesses as they expand into new markets.

Las pasarelas de pago globales suelen venir acompañadas de funciones de seguridad avanzadas para proteger la información de pago de sus clientes, reduciendo el riesgo de fraude. Por ejemplo, aquí en Nomupay, nuestra pasarela viene con un paquete antifraude que consta de 120 herramientas contra el fraude, incluidas las alertas de devolución de cargos, Autenticación 3DS2, comprobaciones AVS y herramientas de detección inteligente.

La mayoría de las pasarelas de pago globales también vienen con paneles de control fáciles de usar que le permiten realizar un seguimiento de las transacciones, gestionar las disputas y generar informes fácilmente. Nuestro Plataforma unificada le permite analizar la información en tiempo real y crear informes personalizados para detectar tendencias de comportamiento que le ayuden a tomar decisiones empresariales más inteligentes.

Ahora que ya sabe cómo funcionan, es posible que se pregunte cuál es el mejor proveedor de pasarelas de pago globales para su empresa. He aquí algunos factores a tener en cuenta:

Para ver la lista completa, consulte nuestro blog sobre aspectos a tener en cuenta al elegir una pasarela de pago.

Una pasarela de pagos global es esencial para las empresas que desean expandirse internacionalmente y aceptar pagos de clientes de todo el mundo. Si entiendes cómo funciona y eliges al proveedor adecuado, podrás agilizar el proceso de pago, aumentar las ventas y ofrecer una mejor experiencia a tus clientes.

Si está listo para ampliar su negocio y abrirse a nuevos mercados, ahora puede ser el momento perfecto para echar un vistazo a la pasarela de pago que utiliza. Para saber más sobre cómo podemos ayudarle a expandirse, póngase en contacto con uno de nuestros especialistas.

To recap, here’s an overview of the top FAQs about global payment gateways

Which is the best payment gateway for international transactions?

The best international payment gateway depends on your business needs. Look for providers that offer multi-currency support, access to local acquirers, low transaction fees and excellent fraud prevention tools.

What is an international card payment gateway?

It’s a payment solution that lets businesses accept global card payments, supporting various card networks like Visa, Mastercard and local payment options.

How do I choose the best international payment gateway for my website?

Look for seamless integrations, currency compatibility, strong security features and transparent pricing.